- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- The Accounting Process

The Accounting Process

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

In this article, we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

Step 1: Identifying Business Stakeholders:

A business stakeholder is a person or entity having an interest in the economic performance of the business. These stakeholders normally include the owners, managers, employees, customers, creditors, and the government.

1. Owners of the Business:

The owners who have invested resources in the business clearly have an interest in how well the business performs. Most owners want to get the most economic value for their investments and they want to maximize the total economic worth of the business. This economic worth includes results of past profits and also reflects prospects for future profits.

2. Managers & the Management:

The managers are the individuals who have been authorized to operate the business on a day to day basis. They are responsible for various functions of the business as per the agreed roles and responsibilities between them and the owners. Managers are primarily evaluated on the economic performance of the business and therefore they also have an interest in maximizing the economic performance of the business.

3. Employees:

The employees provide services to the business in exchange for a paycheck. The employees have an interest in the economic performance of the business because their jobs depend upon it. The better is the economic performance of the business the more security and compensation it offers to the employees.

4. Customers:

The customers usually also have an interest in the continued success of a business. For example, if the company fails on economic performance it may not be able to fulfill its promised obligations making the customers suffer.

5. Creditors:

Like the owners, the creditors invest resources in the business by extending credit, such as a loan or supplying material on credit. They have an interest in how well the business performs because there recovery of credit/investment depends on the capability of the business generating enough cash to pay them back.

6. Governments:

Various governments and statutory bodies have an interest in the economic performance of businesses. Central and State governments collect taxes from businesses within their jurisdictions. Statutory bodies levy various taxes that are based on the economic performance of the business. The better a business does, the more taxes these bodies can collect.

Step 2: Understanding Accounting Needs:

The accounting process starts with the identification of its stakeholders. Discussion in the last paragraph will help you understand who could be a stakeholder for your business and identify the correct stakeholders. The next step in the accounting process is to assess the various information needs of those stakeholders and design the accounting system to meet those needs.

Step 3: Identifying Accounting Transactions:

The next step is to identify the events and activities that have an economic or monetary impact that is to identify accounting transactions. Every economic activity conducted within a business has a direct or indirect effect on the finances of the company. These economic transactions need to be recorded. The accounting process begins with identifying which transactions to record. For economic activity to be considered a transaction, it must be able to be expressed in monetary terms. Also, transactions must be related to the business – stakeholders' or owners' private expenses are never included with business transactions.

Step 4: Recording Transactions:

The next step in the accounting process is to record business activity by entering what accounts a transaction affects and how. Recording transactions includes documenting revenues (by invoices or sales receipts), and entering purchases (in the account payable account) and expenditures (in the check register). This step sometimes also involve high-level accounting tasks, such as recording sales orders, tracking prospective customers, and projecting sales opportunities and cash flow.

To record and classify a transaction to appropriate accounts, a proper understanding of the accounting equation is and accounting standards and practices is a must. Calculating and summarizing transactions in a traditional accounting system is a tedious process and automated accounting frees accountants from these repetitive tasks by calculating and summarizing hundreds or thousands of individual transactions and generating reports to satisfy a variety of stakeholders.

Step 5: Preparing Accounting Reports:

Finally, once the accounting system records the economic data about business activities and events, the next logical step is to prepare the business reports and provide them to the stakeholders according to their informational needs. The double-entry system enables accountants to prepare some standard reports like trial balance, profit, and loss account and balance sheet. Accounting reports are based on generally accepted accounting standards and these reports are powerful tools to help the business owner, accountant, banker, or investor analyze the results of their operations.

Stakeholders use accounting reports as a primary source of information on which they base their decisions. They use other information as well. For example, in deciding whether to extend credit to a company, a banker might use economic forecasts to assess the future demand for the company’s products. The banker might inquire about the ability and reputation of the managers of the business.

Related Links

You May Also Like

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

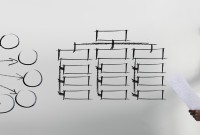

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved