- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Hierarchical Organization Structures

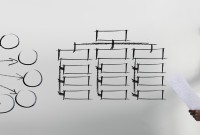

Hierarchical Organization Structures

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down.

Hierarchical structure is typical for larger businesses and organizations. It relies on having different levels of authority with a chain of command connecting multiple management levels within the organization. The decision-making process is typically formal and flows from the top down. This creates a tall organizational structure where each level of management has clear lines of responsibility and control. As the organization grows, the number of levels increases and the structure grows taller.

Often, the number of managers in each level gives the organization the resemblance of a pyramid. This structure gets wider as you move down - usually with one chief executive at the top, followed by senior management, middle managers and finally workers. Employees' roles are clearly defined within the organization, as is the nature of their relationship with other employees.

Two popular types of hierarchical organizational designs are Functional Structures and Divisional Structures.

1. Functional Structure

In a Functional Structure, functions (accounting, marketing, H.R., and so on) are separate, each led by a senior executive who reports to the CEO. This can be a very efficient way of working, allowing for economies of scale as specialists work for the whole organization. There should be clear lines of communication and accountability. However, there's a danger that functional goals can end up overshadowing the overall aims of the organization. And there may be little scope for creative interplay between people in different teams.

2. Divisional Structure

In a Divisional Structure, the company is organized by office or customer location. Each division is autonomous and has a manager who reports to the CEO. A key advantage is that each division is free to concentrate on its own performance, and its people can build up strong local links. However, there may be some duplication of duties. People may also feel disconnected from the company as a whole, and enjoy fewer opportunities to gain training across the business.

The Simple/Flat Structure is common in small businesses. It may have only two or three levels, and people tend to work as a large team, with everyone reporting to one person. It can be a very efficient way of working, with clear responsibilities – as well as a useful level of flexibility.

A potential disadvantage, however, is that this structure can hold back progress when the company grows to a point where the founder or CEO can no longer make all the decisions.

Related Links

You May Also Like

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

Record to report (R2R) is a finance and accounting management process that involves collecting, processing, analyzing, validating, organizing, and finally reporting accurate financial data. R2R process provides strategic, financial, and operational feedback on the performance of the organization to inform management and external stakeholders. R2R process also covers the steps involved in preparing and reporting on the overall accounts.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

Divisional Organizational Structures

The divisional structure or product structure consists of self-contained divisions. A division is a collection of functions which produce a product. It also utilizes a plan to compete and operate as a separate business or profit center. Divisional structure is based on external or internal parameters like product /customer segment/ geographical location etc.

-

Multitude of these legal and operational structures clubbed with accounting and reporting needs give rise to many reporting dimensions at which the organization may want to track or report its operational metrics and financial results. This is where business dimensions play a vital role.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved