- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

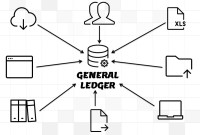

- General Ledger (Record to Report)

- Functional Organizational Structures

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report. One traditional way of organizing people is by function. Some common functions within an organization include production, marketing, human resources, and accounting. This organizing of specialization leads to operational efficiency, where employees become specialists within their own realm of expertise. Business functions are the external directed activity systems of an organization. They are often referred to as business processes or throughput functions. These business functions are concerned with the provision of goods and services to the external customers of the organization. They express the main purpose of the organization, why the business exists.

Example: A motorcar manufacturer could have parallel process lines for different types of cars (e.g. passenger cars, heavy duty vehicles, microbuses, sports cars, etc.). Other examples are the different degree courses and research programs at a university, the different types of projects in an engineering company, different shops in a region, different types of services of a consultant etc.

Functional organizational structures - Differentiation by Function

The grouping of activities according to the type of function performed is the most commonly used structure. This is the most traditional way of organizing people. You would find this not only being widely used in business organization but also in non-commercial organization such as hospitals, universities etc. Some common functions within an organization include production, marketing, human resources, information technology and finance. This organizing of specialization leads to operational efficiencies where employees become specialists within their own realm of expertise. This structure enhances the experience of each function.

Depending on the nature of the organization and its scope of activities, the functions it has to perform may differ vastly from those of another organization. For instance, one company which undertakes both manufacturing and marketing may have departments engaged in purchase, production, marketing and finance. If it is selling a product such as TV or refrigerator it may also have an after-sale-service department.

On the other hand, a company which is an ancillary to a parent company may have only departments for purchase, manufacturing and finance. Since it is selling its entire production to the mother company there is no need for a marketing department.

Business Support Functions:

The provision of a good or service involves processing, namely the transformation of inputs into outputs. This occurs in phases. For example, the business of producing cars involves procurement of parts, the assembly of different parts into a car, other processing (e.g. painting), as well as marketing, selling and delivery. Likewise, a university course involves different disciplines and subjects. Each phase is a sub-activity system or sub-function with its own expertise or functional specialization. These are provided by the business support systems.

Inward-directed activity systems of an organization are known as business support functions. They are concerned with providing resources (e.g. human, material, technological, knowledge and energy) for the different specializations required by the business functions.

Coordinating/Governance Functions:

All functions have their own internal governance, as well as being governed by coordinating organizational governance. Coordinating governance is self-referring activity systems and includes planning, performance management and various regulatory activities. They coordinate all functions within the organization, the business, business support and organization support functions.

Organization Support Functions:

Self-directed activity systems of an organization are known as organization support functions. They are concerned with establishing and maintaining the organization as an entity. Each organization support function provides support to all functions, business, business support and other organization support functions.

For example, corporate finance provides budgets and accounting services to all functions (even to itself). Likewise, the IT function coordinates the flow of data within and between all functions (including its own data flow). Other organization support functions are administration, knowledge management, human resource development, organizational development, legal services and auditing, amongst others.

Center of Excellence Functions:

Another extension to this model could be creation of center of excellence (COE) centers within the organization. COE refers to a team, a shared facility or an entity that provides leadership, evangelization, best practices, research, support and/or training for a focus area. The focus area in this case might be a technology, a business concept, a skill (e.g. negotiation) or a broad area of study. A center of excellence may also be aimed at revitalizing stalled initiatives. It may also be known as a competency center or a capability center. Such a center may bring together faculty members from different disciplines and provide shared facilities.

Main Features

- The functional structure is most suited when an organization is dealing with a single product or service.

- Functional structure allows for specialization of work

- Ensures the most efficient utilization of human resources.

- There is concentration of authority and responsibility in the top man

- Ensures there are no conflicts arising from different authorities

- The hierarchical line of responsibility is very clearly delineated

- Functional specialists may lose sight of the overall organizational objectives and focus only on functional objectives

- Co-ordination among functional departments is needed due to unique set of constraints and problems

Example - Given below is the functional structure for a Services Organization:

Service Organizations are outsourcing providers of functions that have traditionally been performed and audited within the client (user) organization. Their functional organizational structure is usually divided into :

-

Human Resource( HR)

In most companies, HR is split into Recruitment, Training & Talent management. If the scales of operation are very wide Recruitment, Training and Talent management function like different Departments and the job profiles do not overlap at all.

-

Operations

Operations is the most important part of the actual functioning of the company . It is the main earner of the business because it can ‘billed’ for. All other expenses go as ‘costs’ to the company. This category includes employees who actually execute the processes for the customers.

-

Administration

Administration is again a wide function which looks after the day to day functioning of the company starting from transport ,office maintenance, security and running the cafeteria. Some of these are often called transaction processing.

-

Finance

Finance is a back office function that includes a number of services including billing, account payables, general accounting etc.

-

Business Development(BD)/Marketing

Business development includes marketing and other strategic planning. Important decisions with respect to Mergers and Acquisitions (M&A’s) are taken by this department in close coordination with the Finance department. Scanning the market and drawing a map for the company’s future growth depends largely on the efficiency of this Department.

-

Technical

The Technical Department is also a support function .Unlike in an IT Company, this Department ensures systems are in place. As there is extensive use of technology, the Technical Department has the responsible job of ensuring that all software is running smoothly.

Each of these can function as a separate company in terms of the structure. The C-level Executives have the tough job of coordination between different Departments for a smooth and effective functioning. Roles for each Department are quite clearly defined generally.

Related Links

You May Also Like

-

A joint venture (JV) is a business agreement in which the parties agree to develop, for a finite time, a new entity and new assets by contributing equity. They exercise control over the enterprise and consequently share revenues, expenses and assets. A joint venture takes place when two or more parties come together to take on one project.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved