- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

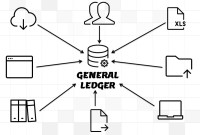

- General Ledger (Record to Report)

- GL - Different Accounting Methods

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

Accounting Methods: Cash V/s Accrual:

Two types of accounting methods are commonly used to record business transactions know as cash accounting and accrual accounting. Under the cash accounting method, revenue is recognized and recorded when the cash is received and expenses are recognized and recorded when the cash payments are made. Under the accrual method of accounting, revenue and expenses are recognized and recorded, when the product or service is actually sold to customers or received from suppliers, generally before they're paid for.

While many small businesses and generally the professionals and professional organizations, use the cash method of accounting, but most businesses tend to use the accrual method. Typically, the single-entry bookkeeping system is used along with the cash method, while the double-entry system can be used with both the cash and accrual methods. The most common combination is double-entry bookkeeping and the accrual method.

Accounting Systems: Single Entry and Double Entry:

There are two common systems of bookkeeping single entry and double-entry accounting systems. The first – single entry – is simplistic, recording each transaction only once, either as revenue or as an expense. Single entry bookkeeping is suitable for organizations that have very few transactions, very few or negligible assets, and liabilities. But when you need a more sophisticated bookkeeping system double-entry bookkeeping system provides you with the tools necessary to represent your accounting data in a meaningful way for use by the stakeholders. Double-entry bookkeeping has become the standard, and is the preferred way of accounting, as it allows businesses to track both the sources and application of money.

Accounting System 1: Single Entry Accounting System:

A single-entry bookkeeping system or single-entry accounting system is a method of bookkeeping relying on a one-sided accounting entry to maintain financial information, based on the income statement (profit or loss statement). The system records the flow of income and expenses through the use of, daily summary of cash receipts and disbursements. The single-entry bookkeeping method records entries once and does not "balance" the transaction out by recording an opposing credit or debit.

A single-entry system may consist only of transactions posted in a notebook, daybook, or journal. However, it may include a complete set of journals and a ledger providing accounts for all important items. A single-entry system for a small business might include a business checkbook, check disbursements journal or register, daily/monthly summaries of cash receipts, a depreciation schedule, employee wages records, and ledgers showing debtor and creditor balances."

Under the method, the intent is to record the bare-essential transactions. In some cases, only records of cash, accounts receivable, accounts payable, and taxes paid may be maintained. Records of assets, inventory, expenses, revenues, and other elements usually considered essential in an accounting system may not be kept, except in memorandum form. Single-entry systems are usually inadequate except where operations are especially simple and the volume of activity is low. Single-entry systems are used in the interest of simplicity. They are usually less expensive to maintain than double-entry systems.

Accounting System 2: Double Entry Accounting System:

Double-entry accounting is a system of organization that records financial transactions in an efficient manner and has been used by accountants for over 500 years. Since the fifteenth century, when Luca Pacioli first wrote about the practice, the term "accounting" has referred to double-entry accounting. Double-entry accounting uses a system of accounts to categorize transactions. Each transaction that is entered consists of one or more debits and credits and the total debits must equal the total credits.

The double-entry bookkeeping system assumes that when a transaction takes place, it impacts two different accounts, one as a debit and the other as a credit. Therefore each transaction is recorded twice. A transaction may also affect more than two accounts, but its total credit amount will always match its total debit amount.

Before a transaction can be recorded, it must be analyzed and classified to determine the accounts it affects and how it affects them. At least two accounts are affected – one with debit and one with credit. Some accounts are increased by debit and others are increased by credit.

Checks & Balancing in Double Entry Accounting Method:

Double-entry accounting provides a system of checks and balances, where the accuracy of the system can be verified by reconciling asset, liability, and equity accounts to external sources. You can uncover simple errors, such as transposing numbers or misplacing a decimal point, when you reconcile accounts. For example, the bank account is reconciled to the bank statement, accounts payable can be reconciled to statements received from suppliers, and accounts receivable can be verified by confirming balances with customers. The inventory account is reconciled by taking a physical count of inventory and comparing the physical account to the accounting records. Because each entry in a double-entry system affects two or more accounts, and debits and credits are equal overall, in a given period of time, balancing the trial balance and reconciling the balance sheet accounts provides a high degree of probability that the profit and loss accounts are correct.

Related Links

You May Also Like

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Introduction to Organizational Structures

Organizations are systems of some interacting components. Levitt (1965) sets out a basic framework for understanding organizations. This framework emphasizes four major internal components such as: task, people, technology, and structure. The task of the organization is its mission, purpose or goal for existence. The people are the human resources of the organization.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

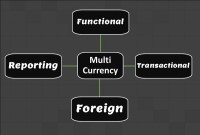

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

-

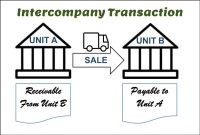

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved