- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Recurring Journal Entries

GL - Recurring Journal Entries

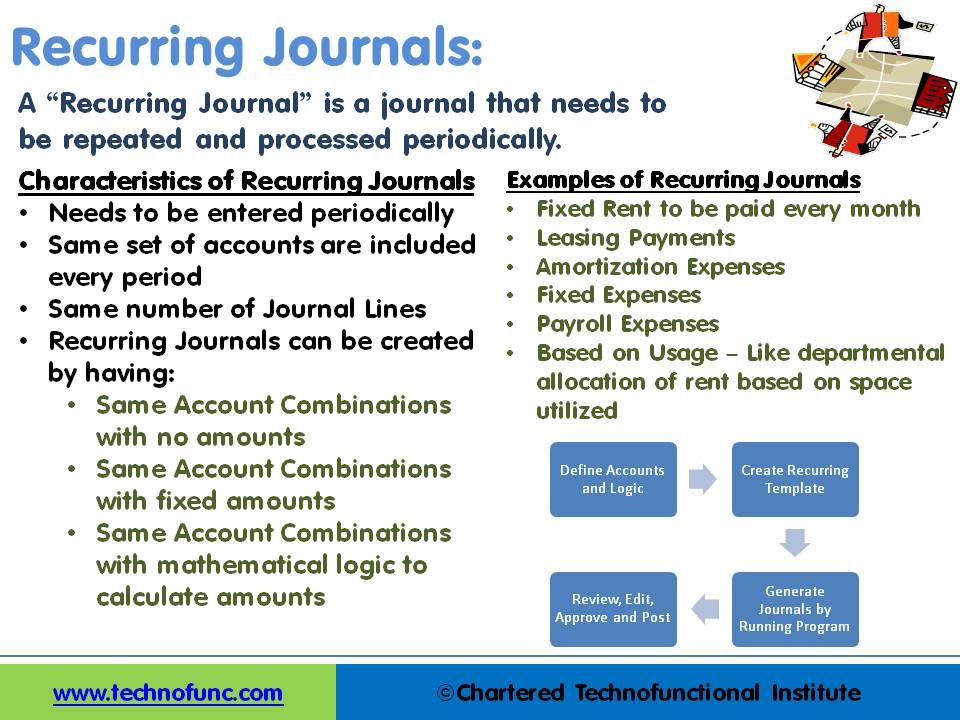

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

What is a Recurring Journal?

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Each accounting period the journal should have the same accounts but the amounts could be different. A recurring journal entry enables you to automate similar or repeating entries. For users who need to post certain transactions frequently with few or no changes, it is an advantage to use recurring journals.

Recurring entries allow for common repeatable transactions to be saved in a template and created in multiple accounting periods upon request, making it unnecessary to retype the entire transaction thereby improving productivity. The Auto-generation of recurring accounting entries minimizes the occurrence of errors and omissions. Systems allow the generation of recurring entries at weekly, monthly, or any other frequency.

Characteristics of Recurring Journals:

-

Needs to be entered periodically

-

The same set of accounts are included every period

-

The same number of Journal Lines

-

Logic exists to define the line selection criteria

-

Simplifies the process of recording repetitive journal entries

-

Creates same journal entries with varying or same amounts in different accounting periods

Methods to Create Recurring Journals:

1. Same Account Combinations with no amounts:

This is useful when the same accounts need to be used every period however the amounts get changed every time. In this scenario, the template is defined with no amounts, and amounts are entered manually every accounting period for which the entry needs to be generated.

2. Same Account Combinations with fixed amounts:

This is useful when both accounts and amounts can be pre-determined. A good example of this scenario is fixed rent payable each month on a specific date. In this case, the template is defined with actual amounts, and journals are created and posted for relevant accounting periods.

3. Same Account Combinations with mathematical logic to calculate amounts:

This is useful when accounts can be pre-determined and amounts will be based on some logic or pre-defined formula. A good example of this scenario could be defining salesmen accounts as the pre-determined accounts. The commission is to be paid to these salesmen as a fixed percentage of sales made by each salesman during the month and sales for each salesman are recorded in separate accounts. A recurring journal can be defined that can look for the balance in respective sales accounts at the end of the period and automatically calculate the commission and create the required accounting entry for commission payable.

Examples of Recurring Journals:

This method works best for repeatable transactions. For example annual expenses that can be charged through twelve equal monthly entries such as, rent or insurance expense allocation or annual lease rentals. Each month 1/12th of the total annual expense can be debited and credited to the appropriate accounts and appear as the current month’s actual transaction. Users can benefit by creating a recurring entry for some of the business scenarios listed below:

- Fixed Rent to be paid every month

- Fixed Insurance to be paid every month

- Leasing Payments

- Amortization Expenses

- Fixed Expenses

- Payroll Expenses

- Based on Usage – Like departmental allocation of rent based on space utilized

- Depreciation

- Allocations

Generic Process to Create Recurring Journals:

Users need to define recurring journal formulas for transactions that they want to repeat every accounting period, such as accruals, depreciation charges, and allocations. The formulas can be simple or complex but need to have some logic of ascertaining the amounts for each of the accounts that need to be repeated. Each formula can use fixed amounts and/or account balances and period-to-date or year-to-date balances from the current period, prior period, or same period last year. Given below is a generic process flow to define recurring journals:

- Define Accounts, Amounts or Formula or Logic

- Create Recurring Template

- Define the accounting periods for which the recurring journals need to be created

- Generate Journals by Running automated recurring journals creation program

- Enter missing data in case of Skelton journals – missing amounts

- Review, Edit, Approve and Post recurring journals

Allocations V/s Recurring Journals:

Recurring Journals are for transactions that repeat every accounting period as explained above and allocation Journals are for single journal entry using an accounting or mathematical formula to allocate revenues and expenses across a group of accounting dimensions like cost centers, departments, divisions, locations, or product lines depending upon usage factors.

Related Links

You May Also Like

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

When the quantum of business is expected to be moderate and the entrepreneur desires that the risk involved in the operation be shared, he or she may prefer a partnership. A partnership comes into existence when two or more persons agree to share the profits of a business, which they run together.

-

Funds contributed by owners in any business are different from all other types of funds. Equity is the residual value of the business enterprise that belongs to the owners or shareholders. The funds contributed by outsiders other than owners that are payable to them in the future. Liabilities are generally classified as Short Term (Current) and Long Term Liabilities. Current liabilities are debts payable within one year.

-

In this article, we will describe how to determine if an account needs adjustment entries due to the application of the matching concept. Learners will get a thorough understanding of the adjustment process and the nature of the adjustment entries. We will discuss the four types of adjustments resulting from unearned revenue, prepaid expenses, accrued expenses, and accrued revenue.

-

In most of the automated financial systems, you can define more than 12 accounting periods in a financial year. This article will explain the concept of the adjustment period and the benefits of having adjustment periods. Adjustment periods have their inherent challenges for the users of financial statements and there is a workaround for those who don’t want to use adjustment periods.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

What is Accounting & Book Keeping

Accounting is a process designed to capture the economic impact of everyday transactions. Each day, many events and activities occur in an entity, these events and activities are in the normal course of business; however, each of these events may or may not have an economic impact. Events or activities that have an effect on the accounting equation are accounting events.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved