- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Accrual Basis Accounting

GL - Accrual Basis Accounting

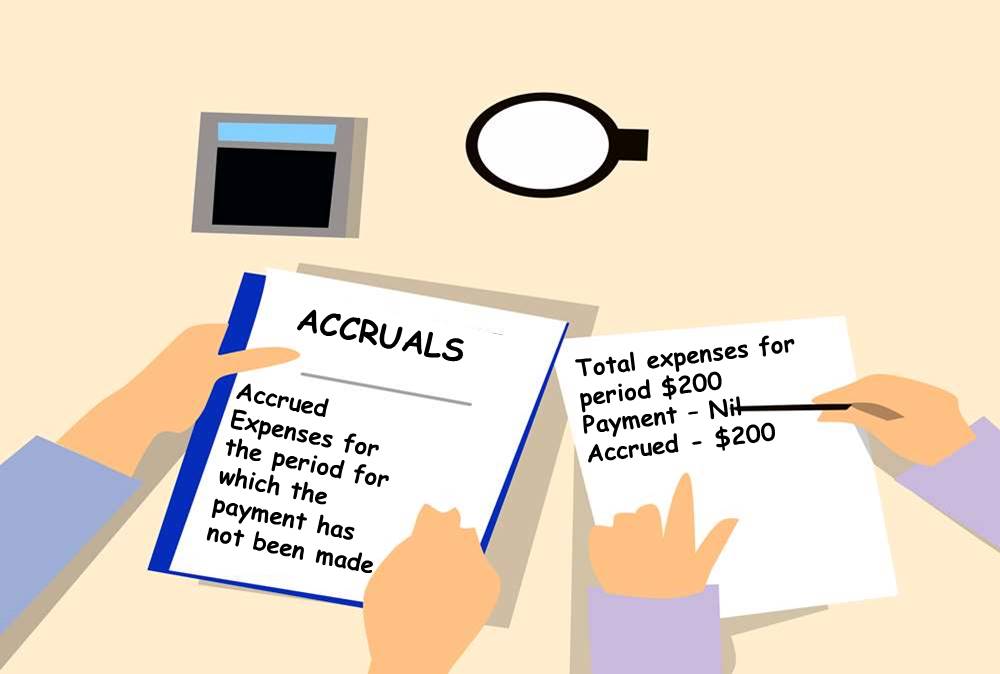

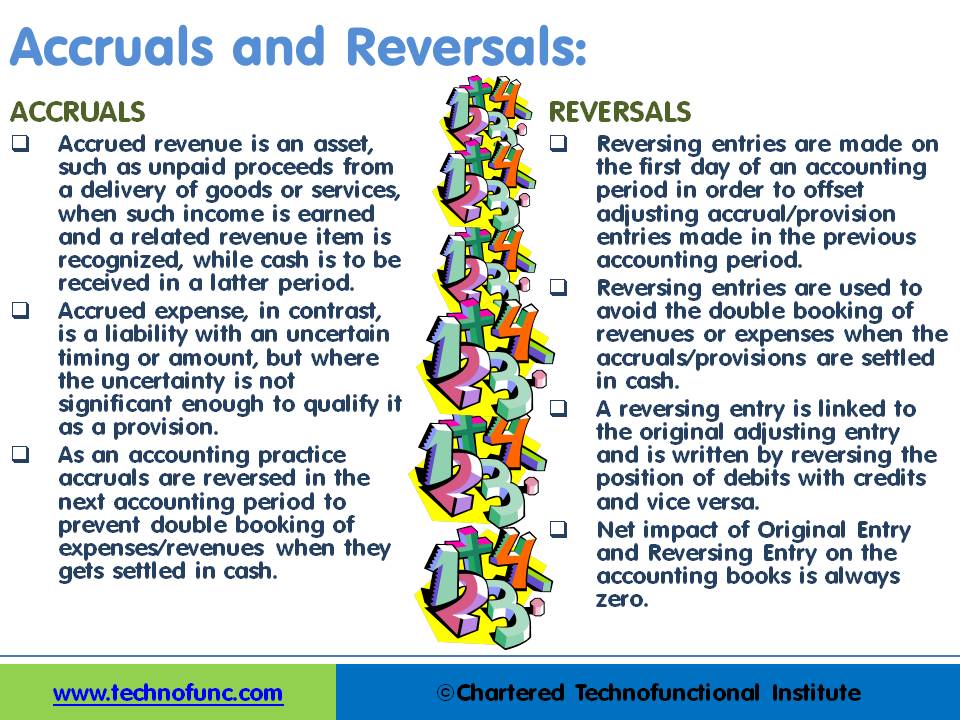

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

Accounting Methods:

There are two commonly used methods of accounting - Cash Basis and the Accruals Basis. In cash basis of accounting, income is recognized in books when it is received in cash, and expenses are offset when they are actually paid.

Cash Basis Accounting:

Some businesses use the cash basis of accounting. Under the cash basis of accounting, revenues and expenses are reported in the income statement in the period in which cash is received or paid. For example, fees are recorded when cash is received from clients, and wages are recorded when cash is paid to employees. The net income (or net loss) is the difference between the cash receipts (revenues) and the cash payments (expenses). Contrary to Cash Basis Accounting, in Accrual Basis Accounting, financial items are accounted for when they are earned and deductions are claimed when expenses are incurred, irrespective of the actual cash flow.

Cash basis accounting is not considered indicative of economic realities, thus the requirement for accrual accounting except for certain kinds of companies, such as very small businesses and some not-for-profit organizations. These businesses may use a cash basis because they have few receivables and payables. For example, attorneys, physicians, and real estate agents often use the cash basis. For them, the cash basis will yield financial statements similar to those prepared under the accrual basis. For most large businesses, the cash basis will not provide accurate financial statements for user needs. For this reason, we need to understand the significance and principles guiding the accrual concept.

Accrual Basis Accounting:

The Accrual accounting method measures the financial performance of a company by recognizing accounting events regardless of when corresponding cash transactions occur. Accrual follows the matching principle in which the revenues are matched (or offset) to expenses in the accounting period in which the transaction occurs rather than when payment is made (or received).

Significance of Accrual Basis Method:

When accountants prepare financial statements, they assume that the economic life of the business can be divided into time periods. Using this accounting period concept, accountants must determine in which period the revenues and expenses of the business should be reported. To determine the proper period, accountants use generally accepted accounting principles, which require the use of the accrual basis of accounting. Accrual accounting is considered to be the standard accounting practice for most companies and is the most widely used accounting method in the automated accounting system.

This method provides a more accurate picture of the company's current condition, but as all income and expenses need to be recognized based on their occurrence and matching, it is relatively complex when compared to cash accounting, which recognizes transactions only when there is an exchange of cash. The need for this method arose out of the increasing complexity of business transactions and investor demand for more timely and accurate financial information.

Many small and large businesses keep their books on an accrual basis, usually for one or more of three reasons:

- They're concerned about gross margin on products they sell.

- They want to really know when they're making money and when they're not.

- They're required by lenders, investors, or government authorities to report their activities that way.

These are all good reasons to use accrual basis accounting, and most experts would commend that choice. But many of these same companies look only at their income statements and often don't even prepare cash flow reports. Instead, they rely on good old rule-of-thumb methods to manage the cash so that they don't run short or let unused cash sit idle.

Accruals: The Revenue Concept

Under the accrual basis of accounting, revenues are reported in the income statement in the period in which they are earned. For example, revenue is reported when the services are provided to customers. Cash may or may not be received from customers during this period. The accounting concept that supports this reporting of revenues is called the revenue recognition concept.

Accruals: The Matching Concept

Under the accrual basis, expenses are reported in the same period as the revenues to which they relate. For example, electricity expenses are reported as an expense in the period in which it was consumed to provide services to customers, and not necessarily when the bill is paid. The accounting concept that supports reporting revenues and related expenses in the same period is called the matching concept, or matching principle. By matching revenues and expenses, net income or loss for the period will be properly reported on the income statement. The GAAP concept that governs this is called the matching principle. Expenses should be matched to benefits, which means recorded in the period of time that benefited from the expenditure rather than the period of time in which the expenditure occurred. The accounting concepts that reflect this principle include Depreciation, Amortization, Accruals, Reserves and Prepaid expenses.

Some Examples of Accruals:

To help you understand this concept let’s look at an example. A company has sold merchandise on credit to a customer who is creditworthy and there is an absolute certainty that the payment will be received in the future. The company earns a profit of $500 on the total sales price of $2000. The accounting for this transaction will be different in the two methods. The revenue generated by the sale of the merchandise will only be recognized by the cash method when the money is received by the company which might happen next month or next year. However in the Accrual Method, the revenue will be recognized in the same period, an “Accounts Receivable” will be created to track future credit payments from the customer. The accounting rules outlined in GAAP require that most companies keep their accounting records on an accrual basis.

Let’s consider another example:

When the Sales Department obtains an order from one of your customers and the product is shipped to the customer, a sale has been consummated and it is recorded. This transaction will appear on the income statement even though not a single dollar may have passed from the customer to your company because the customer has an open account with the company. The transaction is recorded by increasing Sales and by increasing Accounts Receivable, the amount due from your customer. Later on, perhaps the following month, your customer pays his or her bill and your company receives the cash. That transaction will not appear on the income statement. It was already recorded as income when the sale was made and, under accrual accounting rules; only the sale itself is considered an income-producing event, not the act of collecting the money.

This example demonstrates the essence of accrual basis accounting. Transactions are recorded when an economic event is deemed to have occurred. A sale is an economic event because a binding agreement has been reached: your customer agreed to accept the merchandise and pay for it in due course and your company shipped the merchandise on your customer’s promise to pay. That is an economic event, an offer made and accepted.

The customer's payment is another economic event. It is related to the first, but it is nevertheless a new event. The customer might have chosen to delay his or her payment or return the merchandise, but chose instead to pay for it. The second economic event doesn't affect Sales. However, it affects the balance in the customer's account and it increases your company's cash receipts. So when this transaction is recorded, Accounts Receivable and Cash are the accounts that are affected.

Related Links

You May Also Like

-

An organizational design is the process by which a company defines and manages elements of structure so that an organization can control the activities necessary to achieve its goals. Good organizational structure and design helps improve communication, increase productivity, and inspire innovation. Organizational structure is the formal system of task and activity relationships to clearly define how people coordinate their actions and use resources to achieve organizational goals.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

Understand what we mean by GAAP to STAT adjustments. This article discusses the different standards that are used for multiple representations of the financial results for global organizations. Understand the meaning of US GAAP, Local GAAP, STAT, IFRS, and STAT. Finally, understand why accounting differences arise and how they are adjusted for different financial representations.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

Although technically a general ledger appears to be fairly simple compared to other processes, in large organizations, the general ledger has to provide many functionalities and it becomes considerably large and complex. Modern business organizations are complex, run multiple products and service lines, leveraging a large number of registered legal entities, and have varied reporting needs.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved