- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Different Accounting Methods

GL - Different Accounting Methods

The accounting method refers to the rules a company follows in reporting revenues and expenses. Understand the two common systems of bookkeeping, single, and double-entry accounting systems. Learners will also understand the two most common accounting methods; cash and accrual methods of accounting and the advantages and disadvantages of using them.

Accounting Methods: Cash V/s Accrual:

Two types of accounting methods are commonly used to record business transactions know as cash accounting and accrual accounting. Under the cash accounting method, revenue is recognized and recorded when the cash is received and expenses are recognized and recorded when the cash payments are made. Under the accrual method of accounting, revenue and expenses are recognized and recorded, when the product or service is actually sold to customers or received from suppliers, generally before they're paid for.

While many small businesses and generally the professionals and professional organizations, use the cash method of accounting, but most businesses tend to use the accrual method. Typically, the single-entry bookkeeping system is used along with the cash method, while the double-entry system can be used with both the cash and accrual methods. The most common combination is double-entry bookkeeping and the accrual method.

Accounting Systems: Single Entry and Double Entry:

There are two common systems of bookkeeping single entry and double-entry accounting systems. The first – single entry – is simplistic, recording each transaction only once, either as revenue or as an expense. Single entry bookkeeping is suitable for organizations that have very few transactions, very few or negligible assets, and liabilities. But when you need a more sophisticated bookkeeping system double-entry bookkeeping system provides you with the tools necessary to represent your accounting data in a meaningful way for use by the stakeholders. Double-entry bookkeeping has become the standard, and is the preferred way of accounting, as it allows businesses to track both the sources and application of money.

Accounting System 1: Single Entry Accounting System:

A single-entry bookkeeping system or single-entry accounting system is a method of bookkeeping relying on a one-sided accounting entry to maintain financial information, based on the income statement (profit or loss statement). The system records the flow of income and expenses through the use of, daily summary of cash receipts and disbursements. The single-entry bookkeeping method records entries once and does not "balance" the transaction out by recording an opposing credit or debit.

A single-entry system may consist only of transactions posted in a notebook, daybook, or journal. However, it may include a complete set of journals and a ledger providing accounts for all important items. A single-entry system for a small business might include a business checkbook, check disbursements journal or register, daily/monthly summaries of cash receipts, a depreciation schedule, employee wages records, and ledgers showing debtor and creditor balances."

Under the method, the intent is to record the bare-essential transactions. In some cases, only records of cash, accounts receivable, accounts payable, and taxes paid may be maintained. Records of assets, inventory, expenses, revenues, and other elements usually considered essential in an accounting system may not be kept, except in memorandum form. Single-entry systems are usually inadequate except where operations are especially simple and the volume of activity is low. Single-entry systems are used in the interest of simplicity. They are usually less expensive to maintain than double-entry systems.

Accounting System 2: Double Entry Accounting System:

Double-entry accounting is a system of organization that records financial transactions in an efficient manner and has been used by accountants for over 500 years. Since the fifteenth century, when Luca Pacioli first wrote about the practice, the term "accounting" has referred to double-entry accounting. Double-entry accounting uses a system of accounts to categorize transactions. Each transaction that is entered consists of one or more debits and credits and the total debits must equal the total credits.

The double-entry bookkeeping system assumes that when a transaction takes place, it impacts two different accounts, one as a debit and the other as a credit. Therefore each transaction is recorded twice. A transaction may also affect more than two accounts, but its total credit amount will always match its total debit amount.

Before a transaction can be recorded, it must be analyzed and classified to determine the accounts it affects and how it affects them. At least two accounts are affected – one with debit and one with credit. Some accounts are increased by debit and others are increased by credit.

Checks & Balancing in Double Entry Accounting Method:

Double-entry accounting provides a system of checks and balances, where the accuracy of the system can be verified by reconciling asset, liability, and equity accounts to external sources. You can uncover simple errors, such as transposing numbers or misplacing a decimal point, when you reconcile accounts. For example, the bank account is reconciled to the bank statement, accounts payable can be reconciled to statements received from suppliers, and accounts receivable can be verified by confirming balances with customers. The inventory account is reconciled by taking a physical count of inventory and comparing the physical account to the accounting records. Because each entry in a double-entry system affects two or more accounts, and debits and credits are equal overall, in a given period of time, balancing the trial balance and reconciling the balance sheet accounts provides a high degree of probability that the profit and loss accounts are correct.

Related Links

You May Also Like

-

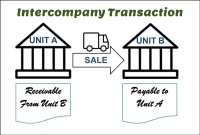

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

Global Business Services (GBS) Model

Global business services (GBS) is an integrated, scalable, and mature version of the shared services model. Global Business Services Model is a result of shared services maturing and evolving on a global scale. It is represented by the growth and maturity of the Shared services to better service the global corporations they support.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

General Ledger - Advanced Features

Modern automated general ledger systems provide detailed and powerful support for financial reporting and budgeting and can report against multiple legal entities from the single system. These systems offer many advanced functionalities right from journal capture to advanced reporting. This article will provide an overview of some advanced features available in today's General Ledgers.

-

Learn the typical accounting cycle that takes place in an automated accounting system. We will understand the perquisites for commencing the accounting cycle and the series of steps required to record transactions and convert them into financial reports. This accounting cycle is the standard repetitive process that is undertaken to record and report accounting.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

-

Accrued expenses, sometimes referred to as accrued liabilities, are expenses that have been incurred but have not been recorded in the accounts. Discuss the need to record accrued liabilities and why they require an adjustment entry. Understand the treatment for these entries once the accounting period is closed and learn to differentiate when the commitments become liabilities.

-

The purpose of the general ledger is to sort transaction information into meaningful categories and charts of accounts. The general ledger sorts information from the general journal and converts them into account balances and this process converts data into information, necessary to prepare financial statements. This article explains what a general ledger is and some of its major functionalities.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved