- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Journal Posting and Balances

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

What is Journal Posting?

As we discussed in the preceding tutorials, a transaction is first recorded in a journal. The journal is a chronological listing of the accounting events. Periodically, the journal entries are transferred to the accounts in the ledger. An organization's ledgers contain each and every account the organization uses, organized by account code. The final step of the bookkeeping phase is, posting to the general ledger. The process of transferring the debits and credits from the journal entries to the accounts is called posting. The ledger is a history of transactions by account. The purpose of posting is to maintain and be able to determine the balance of each specific account.

In practice, businesses use a variety of formats for recording journal entries. The journals may be part of either a manual accounting system or a computerized accounting system. The posting of a journal entry to a ledger account is a straightforward process. Posting transfers information already in the journal, requiring no further analysis. Remember, the key information in the ledger is the same as what's in the journal. The date, description, account names, account codes, and debit and credit amounts are all there in the ledger account, just in a different format.

Posting – Process Difference between Manual and Computerized Accounting Systems:

Manual Accounting Systems: As discussed earlier the preceding steps in the accounting cycle are to identify and analyze the transaction and record by making journal entries. Each single-line journal entry affects two ledger accounts. A typical bookkeeping process records transactions chronologically to a journal, posts daily to subsidiary ledgers, and posts periodically to the general ledger. After posting the transaction to the general ledger, you return to the journal entry and put in the reference number of each ledger account affected by the debit and credit. This indicates to anyone looking at the journal that the entry has been posted to the ledger.

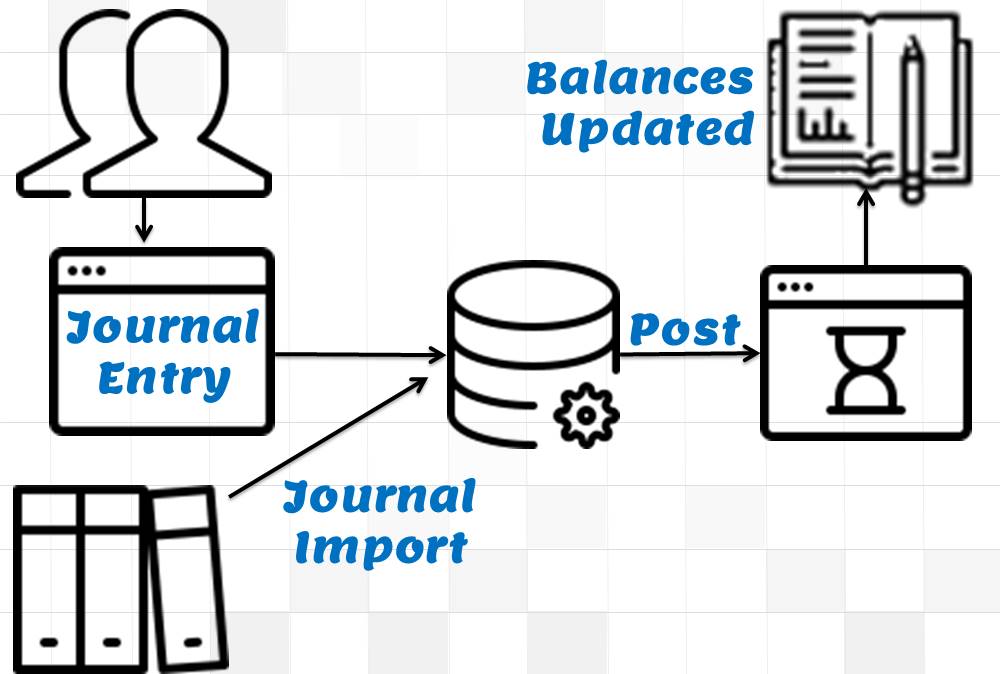

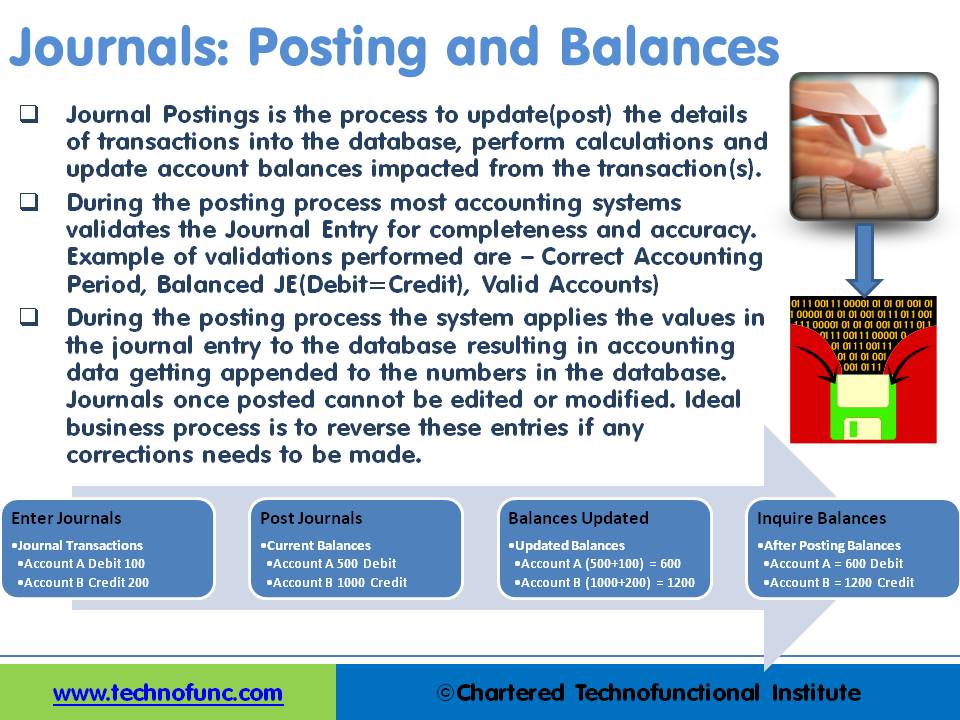

Automated Accounting Systems: In automated accounting systems posting can be understood as the process to update (post) the details of transactions into the database, perform calculations and update account balances impacted by the transaction(s). During the posting process, most accounting systems validate the Journal Entry for completeness and accuracy. Example of validations performed are – Correct Accounting Period, Balanced JE (Debit=Credit), or Valid Accounts

Posting in Automated Systems:

During the posting process, the system applies the values in the journal entry to the database resulting in accounting data getting appended to the numbers in the database. Journals once posted cannot be edited or modified. The ideal business process is to reverse these entries if any corrections need to be made. To verify accounts, total balances from subsidiary ledgers are compared to the totals in each general ledger account.

In the example shown in the figure, in the first step, the journals are entered. Once the journals are entered, they are available in the systems for Review, Approval, and Posting. At this point, current balances in the accounts are not impacted. The next three boxes depict that as the journal gets posted, the current balances are updated to show the impact of the entered transaction. Hence posting is the process to update account balances with the transaction amount.

Posting from Subsidiary Ledgers:

As discussed in earlier tutorials, it is common for businesses to use subsidiary ledgers to track information with similar characteristics. The number and types of subsidiary ledgers and the level of detail contained in each varies substantially with the needs of the organization. There are many possible subsidiary ledgers as explained in examples on subsidiary ledgers article. At the end of a given period – such as a week or a month – the sub-ledger journal information can be posted to the ledgers in summary form, making the process of posting more efficient. Posting to subsidiary ledgers in addition to the general ledger is a good option for when more detail is required.

The relationship between journals, subsidiary ledgers, and the general ledger is slightly more complex than that between general ledger journals and general ledgers. Each subsidiary journal has entries that share the same characteristics, but the listing still reflects changes to two or more accounts in the general ledger. Subsidiary ledgers correspond to the control accounts in the ledger, the journal transaction is entered in sub-ledgers first, usually on a daily basis. Subsequently, these also get posted from the sub-ledgers to the general ledger, usually weekly or monthly.

The general ledger control account balances are checked against the totals in the subsidiary ledgers to ensure correctness at the end of the accounting period. To verify a subsidiary ledger such as the Accounts Receivable ledger, you begin by calculating the sum of the accounts with balances in the subsidiary ledger. You then compare that to the running balance in the accounts receivable control account of the general ledger. If the totals match, you can assume that the ledgers are accurate.

Related Links

You May Also Like

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

Business Metrics for Management Reporting

Business metric is a quantifiable measure of an organization's behavior, activities, and performance used to access the status of the targeted business process. Traditionally many metrics were finance based, inwardly focusing on the performance of the organization. Businesses can use various metrics available to monitor, evaluate, and improve their performance across any of the focus areas like sales, sourcing, IT or operations.

-

What Is a General Ledger? General Ledger (also known in accounting as the GL or the Nominal Ledger) is at the heart of any accounting system. A general ledger is the master set of accounts that summarize all transactions occurring within an entity. Ledger is the skillful grouping and presentation of the Journal entries. Learn the accounting fundamentals, general ledger process, and general ledger flow.

-

Different Types of Organizational Structures

Modern business organizations run multiple product and service lines, operate globally, leverage large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

Legal Structures for Multinational Companies

A multinational company generally has offices and/or factories in different countries and a centralized head office where they coordinate global management. A multinational company (MNC)is a corporate organization that owns or controls the production of goods or services in at least one country other than its home country.

-

Functional Organizational Structures

A functional organizational structure is a structure that consists of activities such as coordination, supervision and task allocation. The organizational structure determines how the organization performs or operates. The term organizational structure refers to how the people in an organization are grouped and to whom they report.

-

Horizontal or Flat Organizational Structures

Flat organizational structure is an organizational model with relatively few or no levels of middle management between the executives and the frontline employees. Its goal is to have as little hierarchy as possible between management and staff level employees. In a flat organizational structure, employees have increased involvement in the decision-making process.

-

In this article we will focus on and understand the accounting process which enables the accounting system to provide the necessary information to business stakeholders. We will deep dive into each of the steps of accounting and will understand how to identify accounting transactions and the process for recording accounting information and transactions.

-

In this article, we explain some commonly used subsidiary ledgers like accounts receivable subsidiary ledger, accounts payable subsidiary ledger or creditors' subsidiary ledger, inventory subsidiary ledger, fixed assets subsidiary ledger, projects subsidiary ledger, work in progress subsidiary ledger, and cash receipts or payments subsidiary ledger.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved