- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- Defining Organizational Hierarchies

Defining Organizational Hierarchies

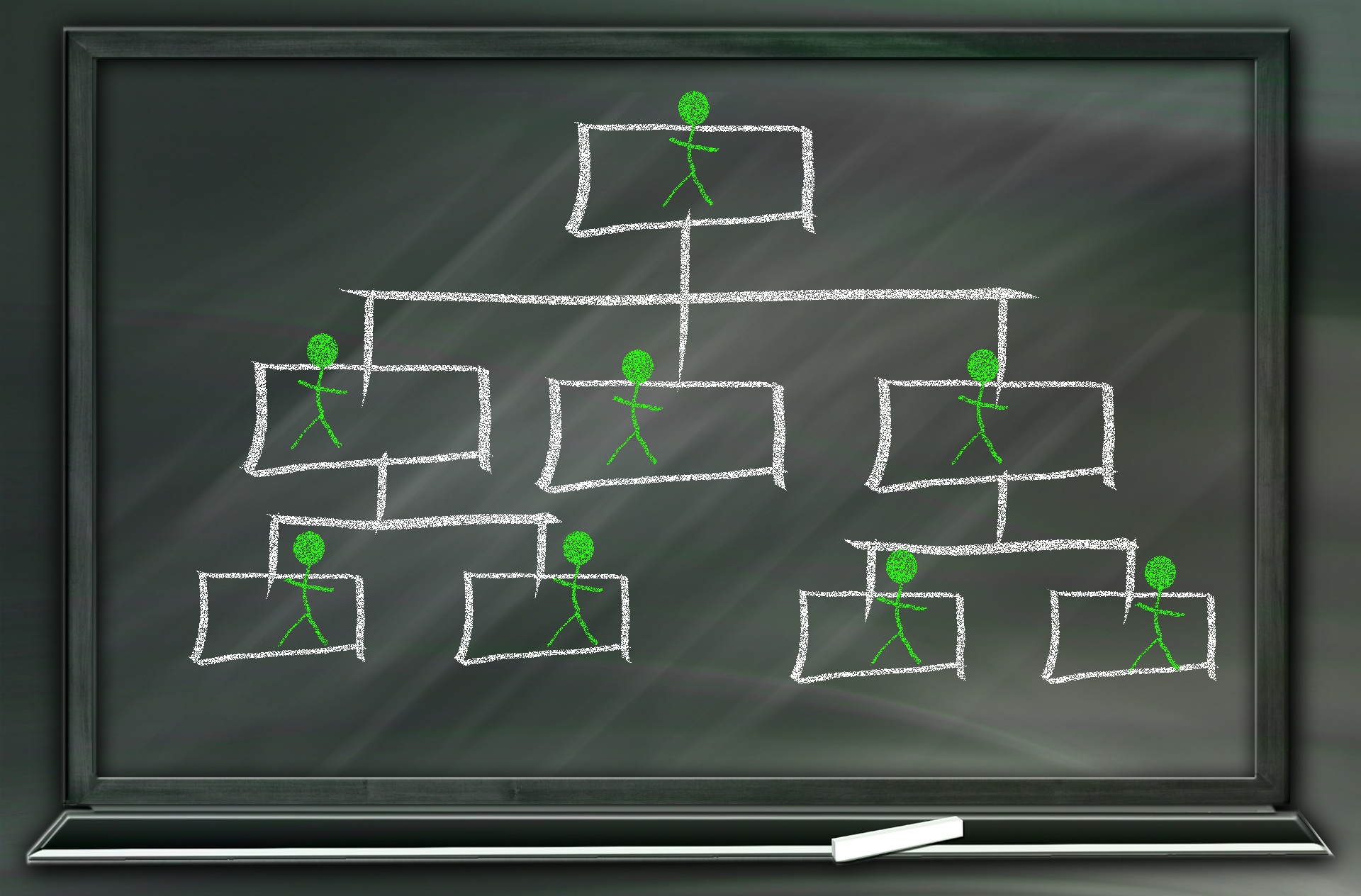

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

Meaning of Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints. These hierarchies need to be mapped to systems to ensure they are capturing the relevant business process information at relevant nodes to provide meaningful information for internal and external reporting.

Example

The account hierarchy allows you to map complex organizational structures of a business partner (for example, buying group, co-operative or chain of retail outlets). When you create a hierarchy structure, you form groups of business partners (for example, for purchasing groups). You can use them for statistical purposes and for marketing and accounting and other meaningful analyses.

Organizational hierarchies

Organizational hierarchies represent the relationships between the units/segments that make up your business.

Larger organizations may require some hierarchies that are based on business units and other hierarchies that are based on shared services, such as human resources and IT. They need to create cost centers in shared service departments and position them under business units, so that the costs of shared services are appropriately allocated. Now we will explore some examples of reporting needs arising out of these different hierarchies and dimensions. Any how they add complexity at transactional level to record relevant information appropriately.

Some areas where we need to deal with dimensions/hierarchies are:

Legal Structure

- Legal Entities

- Subsidiaries

- Tax Entities

- Statutory Entities

Operational Structure

- Business Units/Management Entity

- Divisions/Departments

- Business Functions

- Business Support Functions

- Organization Support Functions

- Cost Centers

- Profit Centers

- Business Employee Hierarchy

- Business Area /Project Area/ Controlling Area/ Product Lines/Service Lines

- Countries/Geography/Locations

- Accounts/Sub Accounts

Importance of Hierarchies

Defining organizational hierarchies enable to view and report on your business from different perspectives. You set up a hierarchy of legal entities for tax, legal, regulatory or statutory reporting. Various Legal entities can enter into legal contracts and are required to prepare statements that report on their performance. While performing business activities we need to capture and classify transactions at legal entity level to be able to identify transactions that belong to a specific legal entity. Therefore, there exists a need to define boundary at legal entity level to enable data classification, consolidation, security and reporting at these entity levels.

Example

A large corporate may create a central mailroom to receive all invoices from its vendors for which it need to make payment. These invoices are raised on separate legal entities within the same corporate group, but mailed to a central processing center for accounting and payment. The shared service resource who is working on these invoices must specify in the Accounting System the different legal entities to ensure proper treatment of these transactions. The payments should be issued from the respective bank accounts belonging to the legal entity on which the invoice has been raised.

You can create a hierarchy for purchasing function to control purchasing policies, rules, and business processes.

Related Links

You May Also Like

-

In this article we will help you understand the double-entry accounting system and state the accounting equation and define each element of the equation. Then we will describe and illustrate how business transactions can be recorded in terms of the resulting change in the elements of the accounting equation.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Explore the concept of journal reversals and understand the business scenarios in which users may need to reverse the accounting entries that have been already entered into the system. Understand the common sources of errors resulting in the reversal of entries and learn how to correct them. Discuss the reversal of adjustment entries and the reversal functionalities in ERPs.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

A subsidiary is a company that is completely or partly owned by another corporation that owns more than half of the subsidiary's stock, and which normally acts as a holding corporation which at least partly or wholly controls the activities and policies of the daughter corporation.

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

Concept of Representative Office

A representative office is the easiest option for a company planning to start its operations in a foreign country. The company need not incorporate a separate legal entity nor trigger corporate income tax, as long as the activities are limited in nature.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved