- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Accrued / Unbilled Revenue

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

What is Accrued Revenue?

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Accrued revenue is treated as an asset on the balance sheet rather than a liability. Accrued revenue refers to revenue that has been incurred but not yet received. It is a temporary debt to the business that has provided the product or service. Examples of accrued revenue items might be services or products you have provided but that have not yet been billed or paid for. This outstanding amount is usually displayed under the label of current assets on the company balance sheet. Accrued revenue becomes unbilled revenue once recognized as unbilled revenue is the revenue that had been recognized but which had not been billed to the purchaser(s).

The amount of the accrued income will also result in a corresponding increase in the entity’s retained earnings account as the accrued revenue adjusting entry also includes a credit to the revenue account.

Which industries generally use Accrued Revenue?

The service industries account for a large number of accrued revenue transactions, since quite often services are provided over a week, month, or even year, but aren't billed until the job is complete.

In the financial services industry, payment is typically based on a particular action, such as creating an account, transferring funds, notarizing a document, or offering advice. It is very common for some fees to be billed to clients after the services have been completed, so there is a delay between the service and the payment that leads to accrued revenue.

In the case of software companies, they work under fixed-price contracts where the payments are based on different milestones. Where the work has been completed and the milestone has not been yet reached, accrued or unbilled revenue exists. Simply put, this pertains to work completed for which a bill has not yet been issued to clients for example the milestone is the Go Live Date of the system, the code has been developed and work of the software company is over but the client has not yet moved the code to the production system.

Accrued revenue is also significant for the construction industry where ~90% of the work is done on credit and payments which come over a period of time. The Percentage-of-completion method is the preferred method for the construction industry whenever the estimates of costs to complete the work can be reasonably made and are dependable. Besides the construction industry, accrued revenue also plays a big role in the rental industry, where unclaimed bills are grouped under accrued revenue.

Utility revenues, derived primarily by providing utility services to consumers like telephone, electricity, gas pipelines, are recognized when the service is delivered to and received by the customer. Revenues include accruals services delivered but not yet billed to customers based on estimates of deliveries (accrued unbilled revenues).

Examples of Accrued Revenues:

- An example of accrued revenue is fees for services that an attorney has provided but hasn’t billed to the client at the end of the period. Other examples include unbilled commissions by a travel agent, accrued interest on notes receivable, and accrued rent on property rented to others.

- Another example of an accrued revenue would be for a custom ordered machine that has been shipped FOB shipping point but the approval to bill the customer has not been received by the billing clerk. An adjusting entry would be recorded to recognize the revenue in the correct period. This entry will reverse when the customer is appropriately invoiced.

- In the case of a landscaping company that has performed work on a lawn for half a month; the company may delay the billing to the customer, accruing it until the client can be billed for a full month of work instead. This gives rise to accrued revenue for the unbilled period.

What are some of the benefits of tracking accrued revenue?

Keeping track of accrued revenue is most important in service-industry businesses that often supply products or services before payment is received. Allowing customers to receive products or services and pay for them later can help increase sales by enticing customers who want to get a product or service but may not have the cash on hand. It can also help businesses that deal with large service contracts by allowing the customer to pay for the service gradually. One disadvantage to allowing this type of arrangement is that the business has incurred the cost of the service before it receives money for the service, which can increase the risk of non-payment until the debt is paid.

Accrued revenue figures are most useful when trying to get a fair valuation of the business, as it can help raise the value of a business that has made sales that have not been paid for. This reporting is very important to the valuation of a company, where billing typically occurs after the work or service is complete. Without this asset class on financial reports, the service companies could appear to have much lower revenues, and may not have a fair method to balance expenses associated with the accrued revenue. Accrued revenues are assets that unless properly accounted for, will not provide an accurate picture of the balance sheet for a business in the case of these industries.

What is the accounting treatment for accrued revenue? Is it an established practice?

From an accounting perspective, the practice of accounting for unbilled revenue is an accepted practice, where the nature of the industry demands recording income that is not billed, on an accruals basis.

For example, the software company would carry out work under a contract that specifies payments based on milestone billing dates that fall shortly after accounting periods. In such instances, the firm would include the revenues in the profit & loss account while declaring accounting results, with a corresponding debit to unbilled revenues in the balance sheet, even though the invoice on the client can be raised only at a later date. The unbilled revenue disclosed as a separate line item in the balance sheet by software companies is a monetary asset similar to accounts receivable, except that the right to receive cash may not have been established through billing as on the balance sheet date.

What is the difference between accrued revenue and accounts receivable?

Accrued revenue and debtors are similar as both of them are current assets but they are different financial terms signifying an important business reality. In both cases, a journal entry is closely related, the revenue is earned before the actual cash has been received, and they represent a resource owned by the entity, which will bring a future economic benefit in the near foreseeable future. They are also different in a subtle but significant way

In case of accounts receivable, the customer has already been delivered goods or services and also the invoice specifying the amount due from the customer, hence a credit sale has occurred, there is a contractual obligation on the customer to pay on the due date and a debtor should be recognized in the books as per the accrual concept. However, in the case of accrued unbilled revenue, the customer has been delivered goods or services, either in full or part; however, the invoice for the same, obligating payment from the customer has not been raised yet. On the day of closing the books, there is no obligation on the customer to pay that amount, however, there exists a reasonable certainty that the customer will be billed and such future invoices will be paid in the due course of time under the normal business cycle.

Recognition of this accrued unbilled income adds to the revenue reported in the income statement, and also results in a corresponding asset on the balance sheet. Future cash collection reduces this asset created in the balance sheet but doesn’t affect accrued revenue recognized in the income statement.

Related Links

You May Also Like

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

Period End Accruals, Receipt Accruals, Paid Time-Off Accruals, AP Accruals, Revenue Based Cost Accruals, Perpetual Accruals, Inventory Accruals, Accruals Write Off, PO Receipt Accrual, Cost Accrual, etc. are some of the most complex and generally misconstrued terms in the context of general ledger accounting. In this article, we will explore what is the concept of accrual and how it impacts general ledger accounting.

-

An account inquiry is a review of any type of financial account, whether it be a depository account or a credit account. In this tutorial, you learn what we mean by drill through functionality in the context of the general ledger system. We will explain the concept of drill-down and how it enables users to perform account and transaction inquiry at a granular level and the benefits of using this functionality.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

The sole trader organization (also called proprietorship) is the oldest form of organization and the most common form of organization for small businesses even today. In a proprietorship the enterprise is owned and controlled only by one person. This form is one of the most popular forms because of the advantages it offers. It is the simplest and easiest to form.

-

GL - Unearned / Deferred Revenue

Unearned revenue is a liability to the entity until the revenue is earned. Learn the concept of unearned revenue, also known as deferred revenue. Gain an understanding of business scenarios in which organizations need to park their receipts as unearned. Look at some real-life examples and understand the accounting treatment for unearned revenue. Finally, look at how the concept is treated in the ERPs or automated systems.

-

In this article we will discuss various types of "Management Entities". Various types of operational units, are created by management, to effectively run, manage and control their business. Different types of functional units, and divisional units, are widely used across industry.

-

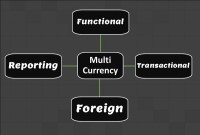

Multi Currency - Functional & Foriegn

Currency is the generally accepted form of money that is issued by a government and circulated within an economy. Accountants use different terms in the context of currency such as functional currency, accounting currency, foreign currency, and transactional currency. Are they the same or different and why we have so many terms? Read this article to learn currency concepts.

-

Introduction to Legal Entities Concept

Modern business organizations operate globally and leverage a large number of registered legal entities, and operate through complex matrix relationships. To stay competitive in the current global business environment, they must often develop highly diverse and complex organizational structures that cross international borders. Learn more about Legal Entities and their importance for businesses.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved