- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- General Ledger (Record to Report)

- GL - Account Allocations

GL - Account Allocations

An allocation is a process of shifting overhead costs to cost objects, using a rational basis of allotment. Understand what is the meaning of allocation in the accounting context and how defining mass allocations simplifies the process of allocating overheads to various accounting segments. Explore types of allocations and see some practical examples of mass allocations in real business situations.

What is Account Allocation?

Allocation is the act of distributing according to a plan. As per the dictionary allocate means to set apart for a special purpose; designate; distribute according to a plan. From an accounting context, it means a system of dividing overhead expenses between the various departments of a business. Figuratively, earmarked is often used in regard to monetary allocations although it is heard in other contexts as well.

The allocation also refers to a piece of the pie, a share in the profits, a portion of whatever is being divided up and parceled out usually money, but in an accounting context is applicable to account balances. This expression probably has its origin in the graphic representation of budget allotments in circular, pie-shaped form, with various sized wedges or pieces indicating the relative size of allocations to different agencies, departments, etc.

Concept of Mass Allocations:

Mass allocations is a functionality offered by many automated systems and ERPs to distribute the account balances from one account to several others based on a formula or mathematic logic. Users can define a Mass Allocation formula to create journals that allocate revenues and expenses across a group of cost centers, departments, divisions, locations, and so on using any accounting dimension available. Users can include parent values in allocation formulas that can enable allocating to the child values referenced by the parent without having to enumerate each child separately.

Different Type of Allocations:

The commonly used allocations can be grouped as follows:

- Net Allocations: allocated amounts that reflect changes to the cost pool.

- Step–Down Allocations: distributing amounts from one allocation pool to a subsidiary allocation pool.

- Rate-Based Allocations: using current, historical, or estimated rates to allocate costs.

- Usage-Based Allocations: using statistics such as headcount, units sold, square footage, number of deliveries, or computer time consumed to calculate allocation amounts.

- Standard Costing Allocations: using statistics such as sales units, production units, number of deliveries or customers served to perform standard costing.

Examples of Allocation:

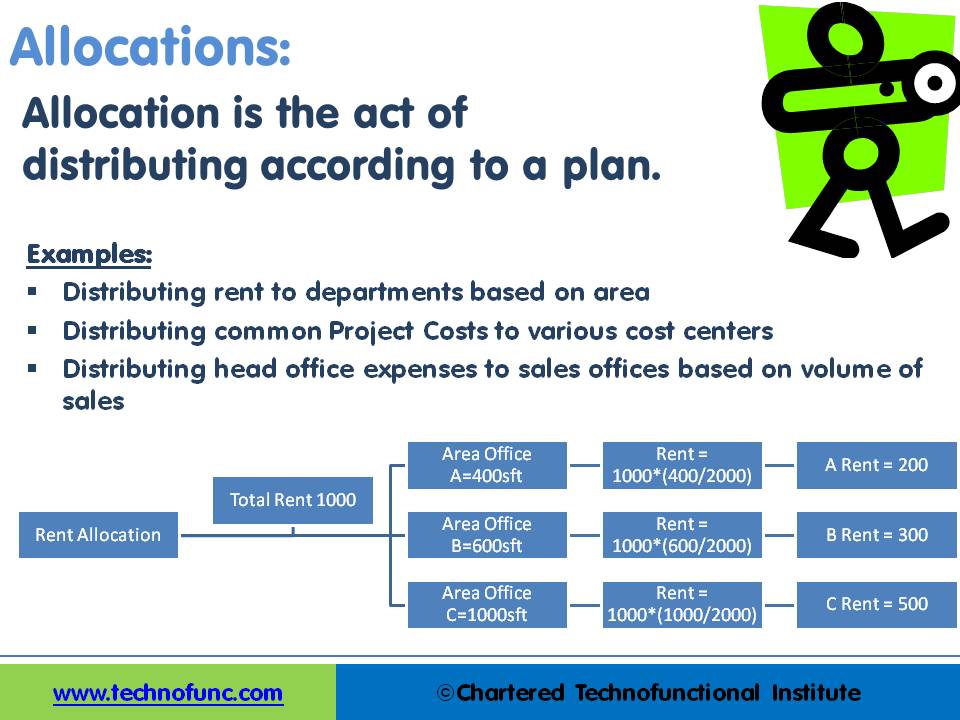

Allocations can be used in various practical business situations. For example, consolidated rent paid can be allocated to another division based on the area of usage, or, a pool of marketing costs can be allocated to several departments based on the ratio of department revenues to total revenues. Some of the commonly used examples are:

- Distributing rent to departments based on area

- Distributing common project costs to various cost centers

- Distributing head office expenses to sales offices based on the volume of sales

- Distributing marketing costs to product lines based on revenue

- Distributing common employee expenses to employee cost for assessments

In the example shown in the figure, we have a company which has taken a 1000 square feet office space on rent. The expenses for rent are borne by the head-office and payment to the landlord is also made by the head office. To know the true profitability of each of the departments (Department A, B & C) the rent needs to be allocated to each one of them.

Each department occupies different areas and the company has taken the measurement of the areas occupied by each of the departments. In the example shown here, the rent is being allocated to different departments based on their usage factor. This is an example of the concept of allocation and automated accounting systems help handle complex allocations programmatically.

Difference between Allocations & Recurring Journals:

Recurring Journals are for transactions that repeat every accounting period and allocation Journals are for single journal entry using an accounting or mathematical formula to allocate revenues and expenses across a group of accounting dimensions like cost centers, departments, divisions, locations, or product lines depending upon usage factors.

Related Links

You May Also Like

-

GL - Different Type of Journals

Two basic types of journals exist: general and special. In this article, the learner will understand the meaning of journalizing and the steps required to create a journal entry. This article will also discuss the types of journals and will help you understand general journals & special journals. In the end, we will explain the impact of automated ERPs on the Journalizing Process.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

Introduction to Organizational Structures

Organizations are systems of some interacting components. Levitt (1965) sets out a basic framework for understanding organizations. This framework emphasizes four major internal components such as: task, people, technology, and structure. The task of the organization is its mission, purpose or goal for existence. The people are the human resources of the organization.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

Generally Accepted Accounting Principles define the accounting procedures, and understanding them is essential to producing accurate and meaningful records. In this article we emphasize on accounting principles and concepts so that the learner can understand the “why” of accounting which will help you gain an understanding of the full significance of accounting.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

For any company that has a large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs to be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger. Understand the concept of the subsidiary ledgers and control accounts.

-

The general ledger is the central repository of all accounting information in an automated accounting world. Summarized data from various sub-ledgers are posted to GL that eventually helps in the creation of financial reports. Read more to understand the role and benefits of an effective general ledger system in automated accounting systems and ERPs.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved