- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Procure to Pay

- Accounts Payable Definition

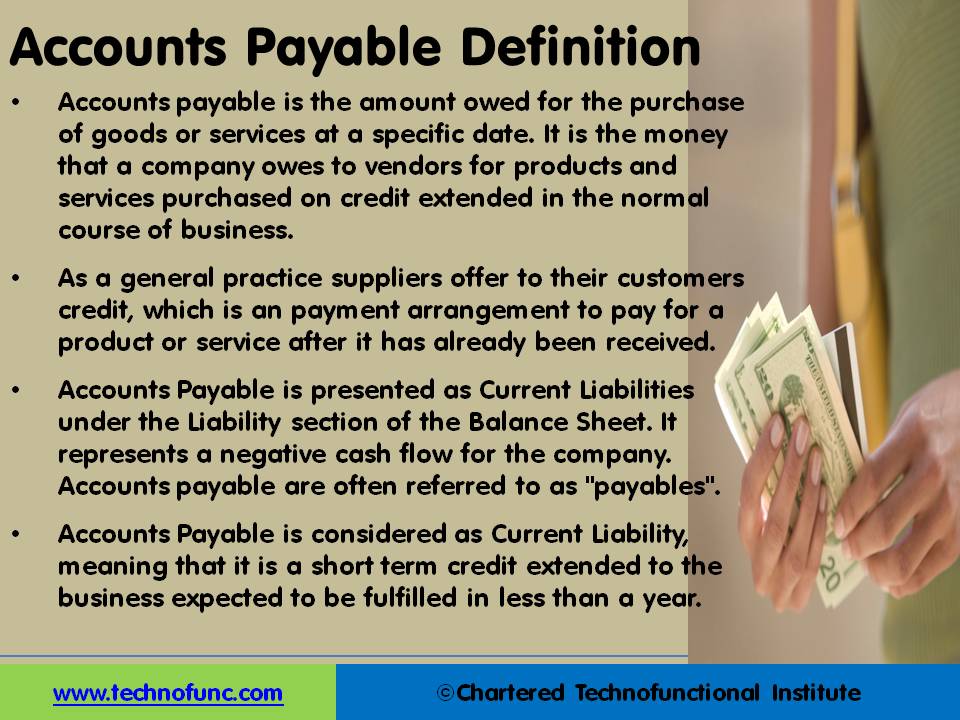

Accounts Payable Definition

Understand what we mean by accounts payable. Why the process is called accounts payable and what are the other names by which this process is known as. Download a ready recokner to keep with you.

What is Accounts Payable

- Accounts payable is the amount owed for the purchase of goods or services at a specific date.

- It is the money that a company owes to vendors for products and services purchased on credit extended in the normal course of business.

- As a general practice suppliers offer to their customers credit, which is an payment arrangement to pay for a product or service after it has already been received.

- Accounts Payable is presented as Current Liabilities under the Liability section of the Balance Sheet. It represents a negative cash flow for the company.

- Accounts payable are often referred to as "payables".

- Accounts Payable is considered as Current Liability, meaning that it is a short term credit extended to the business expected to be fulfilled in less than a year

Related Links

You May Also Like

-

Business Case of Multiple Warehouses

Adding extra warehouses to business provides many benefits such as reducing shipping costs, increasing storage capacity, and having warehouses for specific purposes to simplify overall warehouse management. Multiple warehouses allow you to organize your inventory in a way that helps your business be more effective.

-

Accounts Payable Journal Entry

Although in the large organizations the Procure to Pay Accounting process starts when the purchase order for supply of goods is released to the supplier. To keep things simple in the beginning we will discuss the core accounting entries related to the Accounts Payables process.

-

One of the warehousing best practices that retailers like Walmart, Amazon, and Target have adopted is known as cross-docking. During this process the inbound products are unloaded at a distribution center and then sorted by destination, and eventually reloaded onto outbound trucks. In real parlance, the goods are not at all warehoused but just moved across the dock (hence the name).

-

At a high level, the essential elements in a warehouse are an arrival bay, a storage area, a departure bay, a material handling system and an information management system. As part of the process for enabling a warehouse layout, you must define warehouse zone groups, and zones, location types, and locations.

-

One of the most important decisions when running a warehouse is its layout. Warehouse layout defines the physical arrangement of storage racks, loading and unloading areas, equipment and other facility areas in the warehouse. A good layout aligned with the business needs could have a significant effect on the efficiency.

-

Payables are often categorized as “Trade Payables” & “Expense Payables”. “Trade Payables” are the monies due for the purchase of physical goods that are recorded in Inventory. “Expense Payables” are the monies due for the purchase of goods or services that are expensed.

-

To stay competitive in today’s tough market, the location of your warehouse is vital. To grow retail business need to offer to customers faster and affordable shipping time, which is dependent on the warehousing location as the location of the warehouse affects the transit time to ship orders to customers.

-

Inventory is money, and hence businesses need to perform physical inventory counts periodically to make sure that their inventory records are accurate. The traditional approach to conducting inventory counts is to shut down a facility during a slow time of year to count everything, one item at a time. This process is slow, expensive, and (unfortunately) not very accurate.

-

When products arrive at a facility, there need to be a defined process to let them in. The process for accepting inventory when it arrives is called "Receiving". Any warehousing operation must be able to receive inventory or freight from trucks at loading docks and then stow them away in a storage location. Receiving often involves scheduling appointments for deliveries to occur, along with unloading the goods and performing a quality inspection.

-

Overview of Third-Party Logistics

Third-party logistics (abbreviated as 3PL, or TPL) is an organization's use of third-party businesses to outsource elements of its distribution, warehousing, and fulfillment services. A third-party logistics provider (3PL) is an asset-based or non-asset based company that manages one or more logistics processes or operations (typically, transportation or warehousing) for another company.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved