- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- What is a Bank Statement?

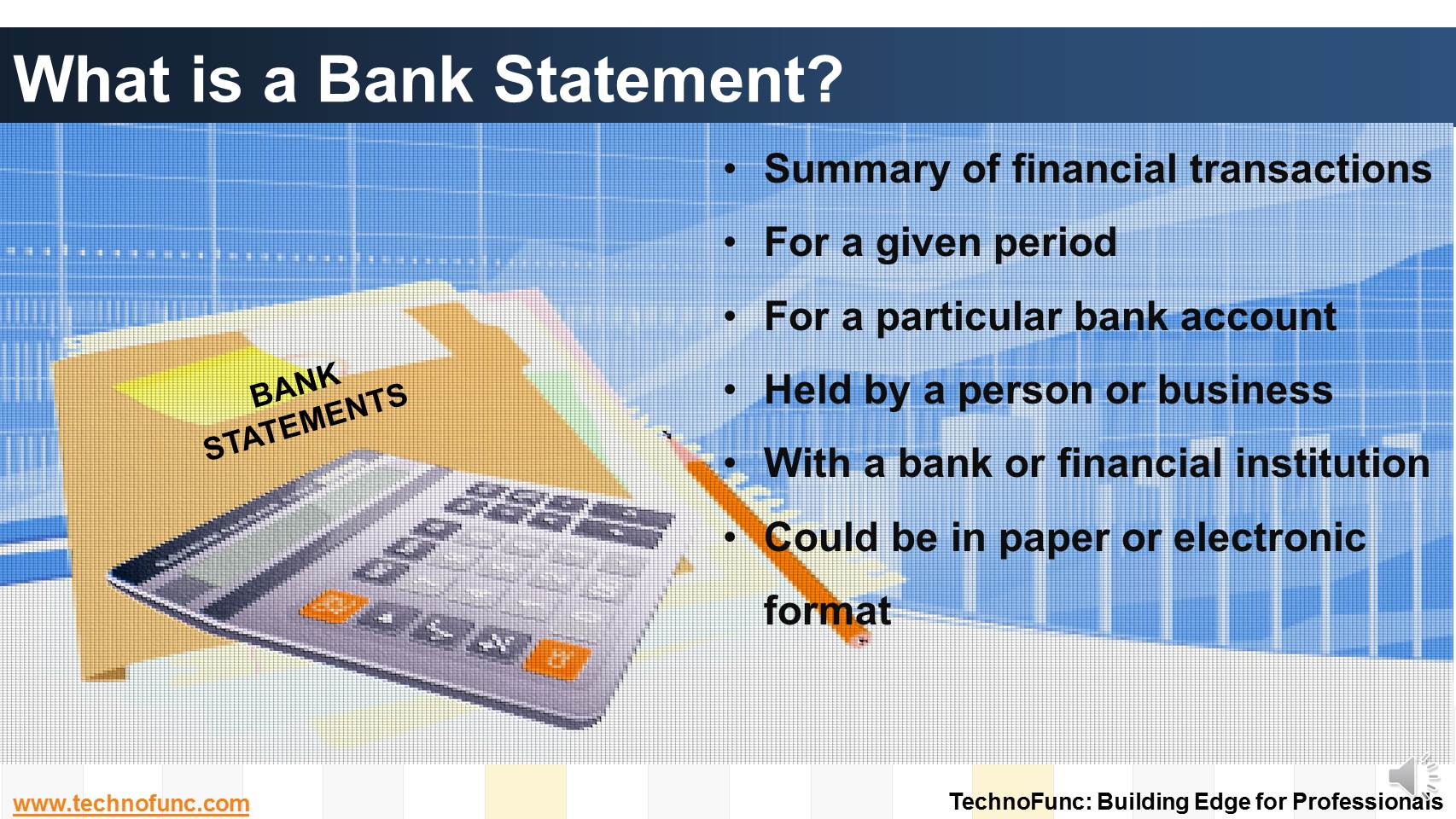

What is a Bank Statement?

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Bank statement or account statement is a summary of financial transactions which have occurred over a given period on a bank account held by a person or business with a financial institution.

Bank statements have historically been and continue to be typically printed on one or several pieces of paper

They are either mailed directly to the account holder, or kept at the financial institution's local branch for pick-up.

In recent years there has been a shift towards paperless, electronic statements

Most financial institutions now offer direct download of bank statement into account holders accounting software.

Key Attributes of Bank Statement:

- Summary of financial transactions

- For a given period

- For a particular bank account

- Held by a person or business

- With a bank or financial institution

- Could be in paper or electronic format

Related Links

You May Also Like

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved