- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Functional

- Cash Management

- Automated Clearing

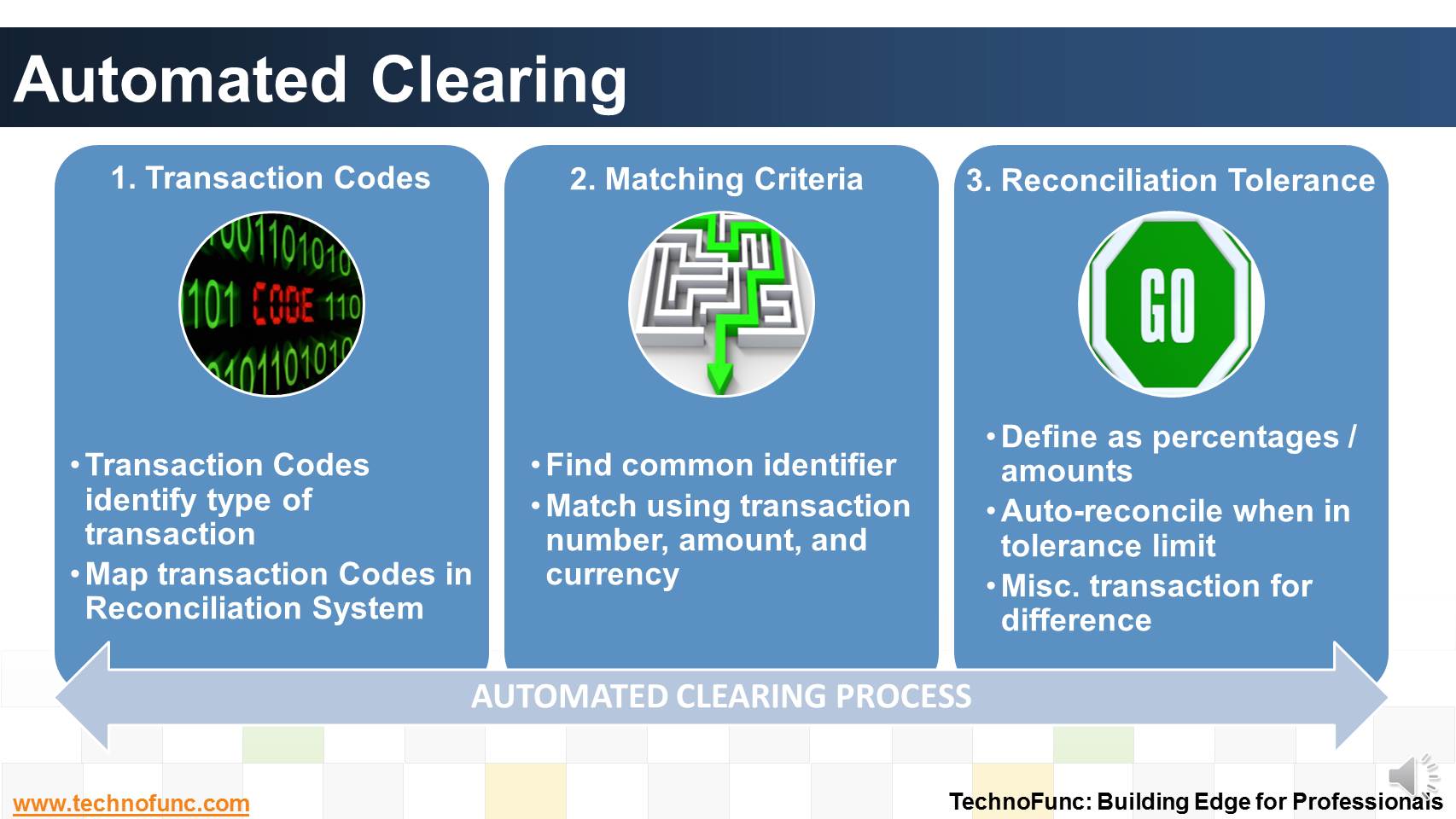

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

Automated Clearing

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions.

This method is ideally suited for bank accounts that have a high volume of transactions.

The following three are the basic steps are involved in Automated Clearing Process:

1 Map Transaction Codes

Bank statement lines are coded to identify the type of transaction the line represents. Since each bank might use a different set of transaction codes, the first step towards automatic clearing is to map each code that is used by a particular bank for which the transactions need to be reconciled.

2 Matching Criteria

Automated matching can only be done if you can find a common identifier between the transaction details as recorded in your sub ledgers and the bank statement.

Automated systems generally match a bank statement line against a payables payment transaction, receivables receipt transaction, payroll disbursals and miscellaneous transactions using a transaction number (such as the payment or deposit number), bank account, amount, and currency.

3 Reconciliation Tolerance:

Reconciliation tolerances are defined in the system as percentages and/or amounts.

If tolerance is defined then the difference between the statement line and sub-ledger transaction line will be auto-reconciled when it is within the tolerance limit. The system also creates a miscellaneous transaction for the difference between the remittance batch amount and the bank statement line.

Related Links

You May Also Like

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

Treasury Management - Functions

Treasury management has become an specialized function. Treasury function helps in managing the Risk-return profile as well as the tax-efficiency of investment instruments. In larger firms, it may also include trading in bonds, currencies and financial derivatives. Learn about the various tasks, activities and imperatives, undertaken by treasuries in in today's context.

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved