- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- General Ledger Process Flow

General Ledger Process Flow

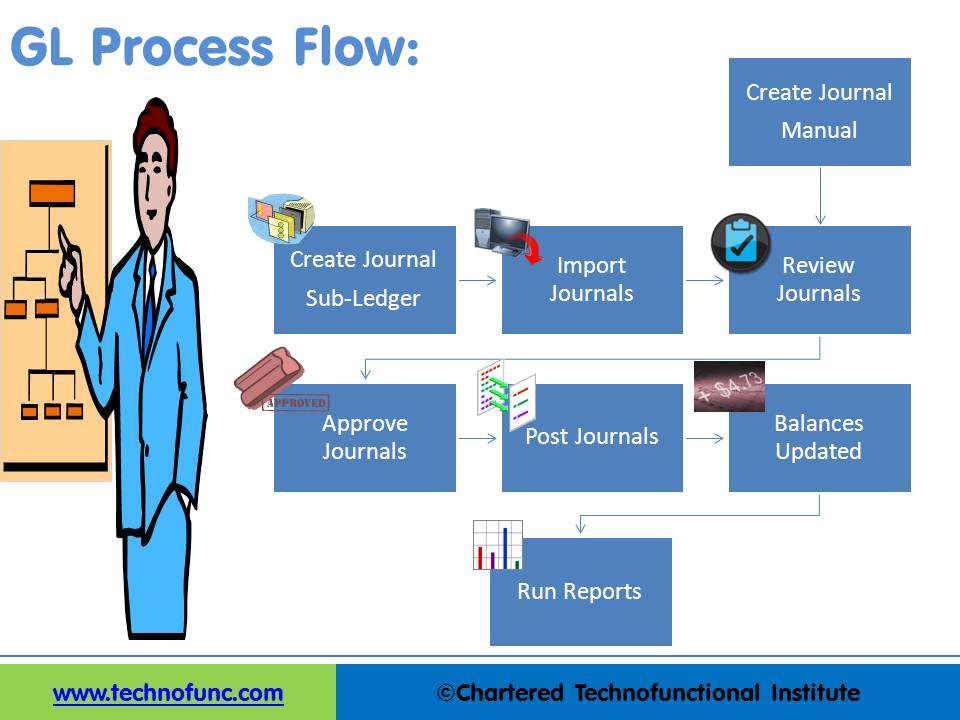

In this article, we will explain the general Ledger journal processing flow from entering journals to running the final financial reports. Understand the generic general ledger process flow as it happens in automated ERP systems. The accounting cycle explains the flow of converting raw accounting data to financial information whereas general ledger process flow explains how journals flow in the system.

GL process flow is a five-step process from recording the transactions in the system to finally running the reports containing financial data out of the system. The input for GL Process Flow is the raw accounting data and the output is the accounting reports that can be used to provide various levels of financial information.

The steps in the general ledger process flow are:

- Step1. Create Journal or Import Journal from Sub‐Ledger

- Step2: Review Journals

- Step3: Approve Journals

- Step4: Journals Posting

- Step5: Run Financial Reports

Step 1: Create Journal or Import Journal from Sub‐Ledger:

Accounting Journals can be created directly in General Ledger. They can also be created in subsidiary ledgers and can then be imported to General Ledger. In the previous lesson, we saw some examples of commonly used subsidiary ledgers. Companies extensively use modules like accounts receivable, accounts payable, inventory, assets, projects, and cash management subsidiary ledgers. Data created in these sub-systems need to be imported to the general ledger for further processing, The accounting lines from sub-ledgers can be imported in summarized form or detailed form.

General Ledger also allows users to directly add transactions in the GL. In that case, you need to follow the accounting principles and the steps explained in the accounting process. At this stage, the journals are entered into the system and available for further processing, but they have not impacted the general ledger account balances yet.

Step 2: Review Journals:

Once the Journal is available in the General Ledger System you can query the journals that have been created. While reviewing the journal, you can make edits/corrections if required.

You might need to make some adjustments to the journals coming from other sources if you want to change the accounts or amounts that are coming from the sub-systems. Review functionality gives the capability to query the journals based on different parameters and also make edits if required.

Step 3: Approve Journals:

Accounting prudence requires that all financial transactions should be reviewed by someone other than the person creating the transaction. Approval ensures the validity and correctness of the transaction. The segregation of the Duties concept requires that the responsibility for related operations should be divided among two or more persons. This decreases the possibility of errors and fraud.

In this step, the system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results. Email notifications can be sent to the approvers using the system and they can review and approve the journals. This step is generally optional and many organizations skip this step by putting additional controls in the process. If this feature is enabled then the journal cannot be posted unless it has been approved.

Step 4: Journals Posting:

An important feature of the general ledger is the "Balance" column, which keeps a running balance for each of the accounts pertaining to which transactions are happening. The transactional data captured through journals in the previous steps is transferred periodically to the columns in the general ledger. Journals posting is a process of updating the database with the amounts.

The volume of transactions carried out by a business will indicate how often to post. A busier company may post daily, while other companies may post weekly or monthly. Periodic postings is required to ensure balances for accounts are current, so the business has the up-to-date financial information it needs to make quick decisions. All transactions must be posted to the ledger at the end of an accounting period. Once the Journals are posted users can query for updated account balances using the account inquiry functions.

Journals Balances Updated: The posting process updates the journal balances. You can inquiry about the account balances in General Ledger for all posted transactions.

Step 5: Run Financial Reports:

One way to determine the financial progress of any organization is to look at the profit gained by a business. Once you have the account balances and transactional data available in the system they need to be formatted to meaningful information that can help users understand the financial history as well as equip them to make informed decisions. To enable these business users to need many types of financial reports.

The next step in the general ledger process is to generate these useful reports and the most common reports run from General Ledger are Transactions Register and Trial Balance Report. ERPs come with a large number of seeded reports as well as with tools to define user-specified reports.

Given above is the generic general ledger process. Some systems may have slight variations to the above process, but the underlying concepts remain more or less the same!

Related Links

You May Also Like

-

Reversing Journals are special journals that are automatically reversed after a specified date. A reversing entry is a journal entry to “undo” an adjusting entry. When you create a reversing journal entry it nullifies the accounting impact of the original entry. Reversing entries make it easier to record subsequent transactions by eliminating the need for certain compound entries. See an example of reversing journal entry!

-

This article explains the process of entering and importing general ledger journals in automated accounting systems. Learn about the basic validations that must happen before the accounting data can be imported from any internal or external sub-system to the general ledger. Finally, understand what we mean by importing in detail or in summary.

-

Team-Based Organizational Structure

Team-based structure is a relatively new structure that opposes the traditional hierarchical structure and it slowly gaining acceptance in the corporate world. In such a structure, employees come together as team in order to fulfill their tasks that serve a common goal.

-

GL - Understanding Chart of Accounts

A chart of accounts (COA) is a list of the accounts used by a business entity to record and categorize financial transactions. COA has transitioned from the legacy accounts, capturing just the natural account, to modern-day multidimensional COA structures capturing all accounting dimensions pertaining to underlying data enabling a granular level of reporting. Learn more about the role of COA in modern accounting systems.

-

There are five types of core accounts to capture any accounting transaction. Apart from these fundamental accounts, some other special-purpose accounts are used to ensure the integrity of financial transactions. Some examples of such accounts are clearing accounts, suspense accounts, contra accounts, and intercompany accounts. Understand the importance and usage of these accounts.

-

Defining Organizational Hierarchies

A hierarchy is an ordered series of related objects. You can relate hierarchy with “pyramid” - where each step of the pyramid is subordinate to the one above it. One can use drill up or down to perform multi-dimensional analysis with a hierarchy. Multi-dimensional analysis uses dimension objects organized in a meaningful order and allows users to observe data from various viewpoints.

-

Internally, an organization can be structured in many different ways, depending on their objectives. The internal structure of an organization will determine the modes in which it operates and performs. Organizational structure allows the expressed allocation of responsibilities for different functions and processes to different entities such as the branch, department, workgroup and individual.

-

Driving Business Efficiency through Divisions and Departments

In case of a multi-divisional organizational structure, there is one parent company, or head-office. And that parent owns smaller departments, under the same brand name. Dividing the firm, into several self-contained, autonomous units, provides the optimal level of centralization, in a company.

-

Trial Balance in General Ledger

One of the greatest benefits of using a double-entry accounting system is the capability to generate a trial balance. What do we mean by trial balance? As the name suggests a trial balance is a report that must have its debits equals to credits. Understand the importance of trial balance and why it is balanced. Learn how it is prepared and in which format.

-

GL - Journal Posting and Balances

In this tutorial, we will explain what we mean by the posting process and what are the major differences between the posting process in the manual accounting system compared to the automated accounting systems and ERPs. This article also explains how posting also happens in subsidiary ledgers and subsequently that information is again posted to the general ledger.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved