- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Sources of Cash

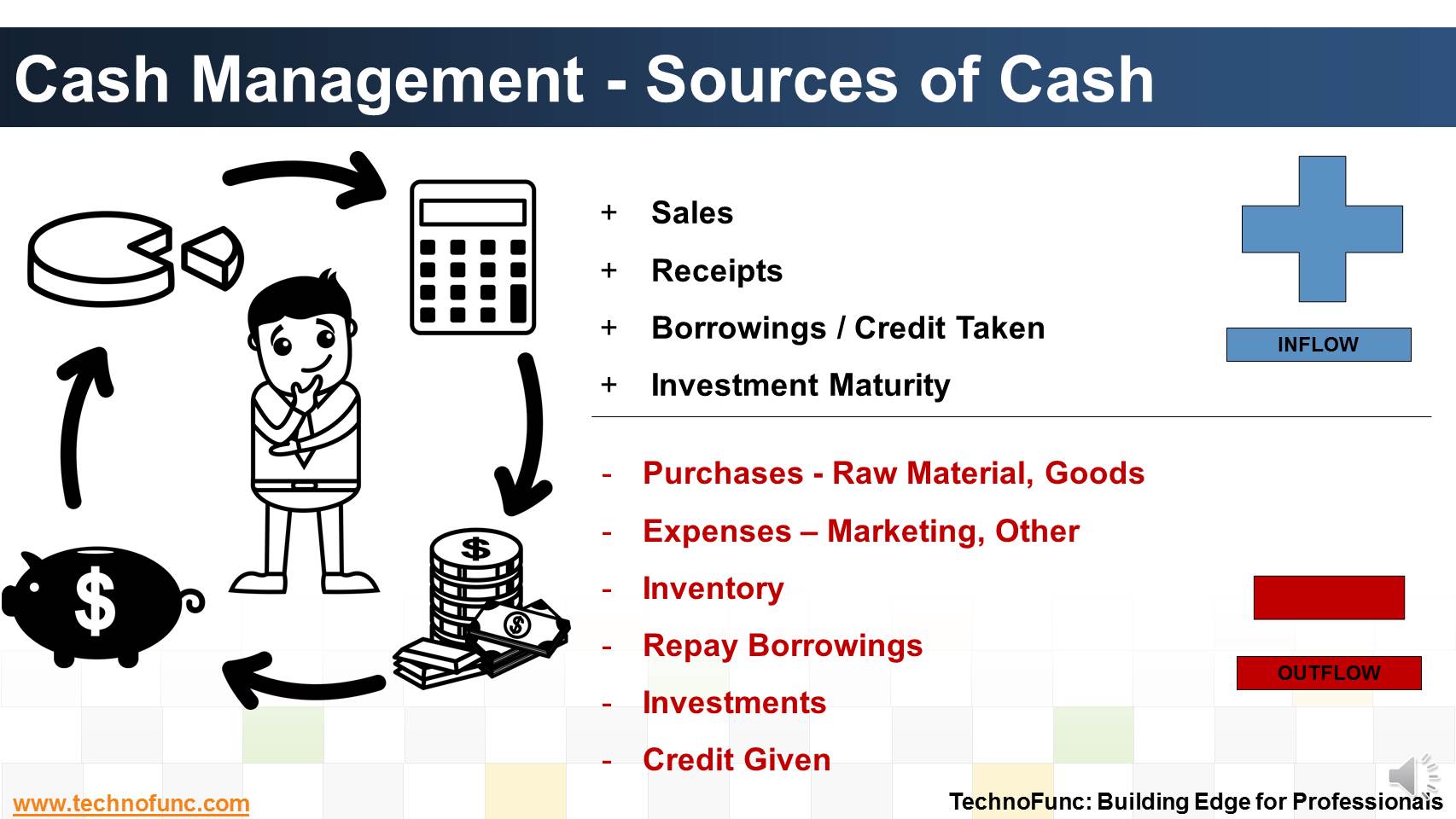

Sources of Cash

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

Every successful company has a pool of cash that sustains the day-to-day activities of business.

It grows with receipts from sales and contributions and shrinks with expenditures for inventory, marketing, labor and other expenses.

The uncertainty of cash inflows and outflows creates the challenge of ensuring that sufficient funds are available at all times to support the operating cycle.

Borrowing becomes necessary when cash flow falls short of covering disbursements.

When incoming funds exceed the outflow, cash is used to repay borrowings or purchase short-term investments until the cash is needed to cover future expenses.

Financial officers need timely information to properly control and use their funds throughout the cash flow cycle.

The Basic Cash Management Process provides that timely information.

Related Links

You May Also Like

-

What are the various sources of cash in an organization. Which sources increase the cash available with the enterprise and which sources results in outflow of the cash? Let us explore!

-

Complete Bank Reconciliation Process

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

-

Before we dive into cash management, let us fist understand what we mean by cash and what constitutes cash in context of cash management process.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Introduction to Bank Reconciliation Process

These set of articles provide a brief introduction to Bank Reconciliation Process. This topic not only discusses the meaning of bank reconciliation process but also discusses how this process in handled in new age ERPs and Automated Reconciliation Systems.

-

How the inflow and outflow of cash is linked to the operating cycles of the business? Learn the cash management process in an enterprize and it's key components.

-

What is Account Reconciliation?

Before you understand the Bank Reconciliation Process it is important to understand what is account reconciliation and why it is carried out.

-

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved