- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Complete Bank Reconciliation Process

Complete Bank Reconciliation Process

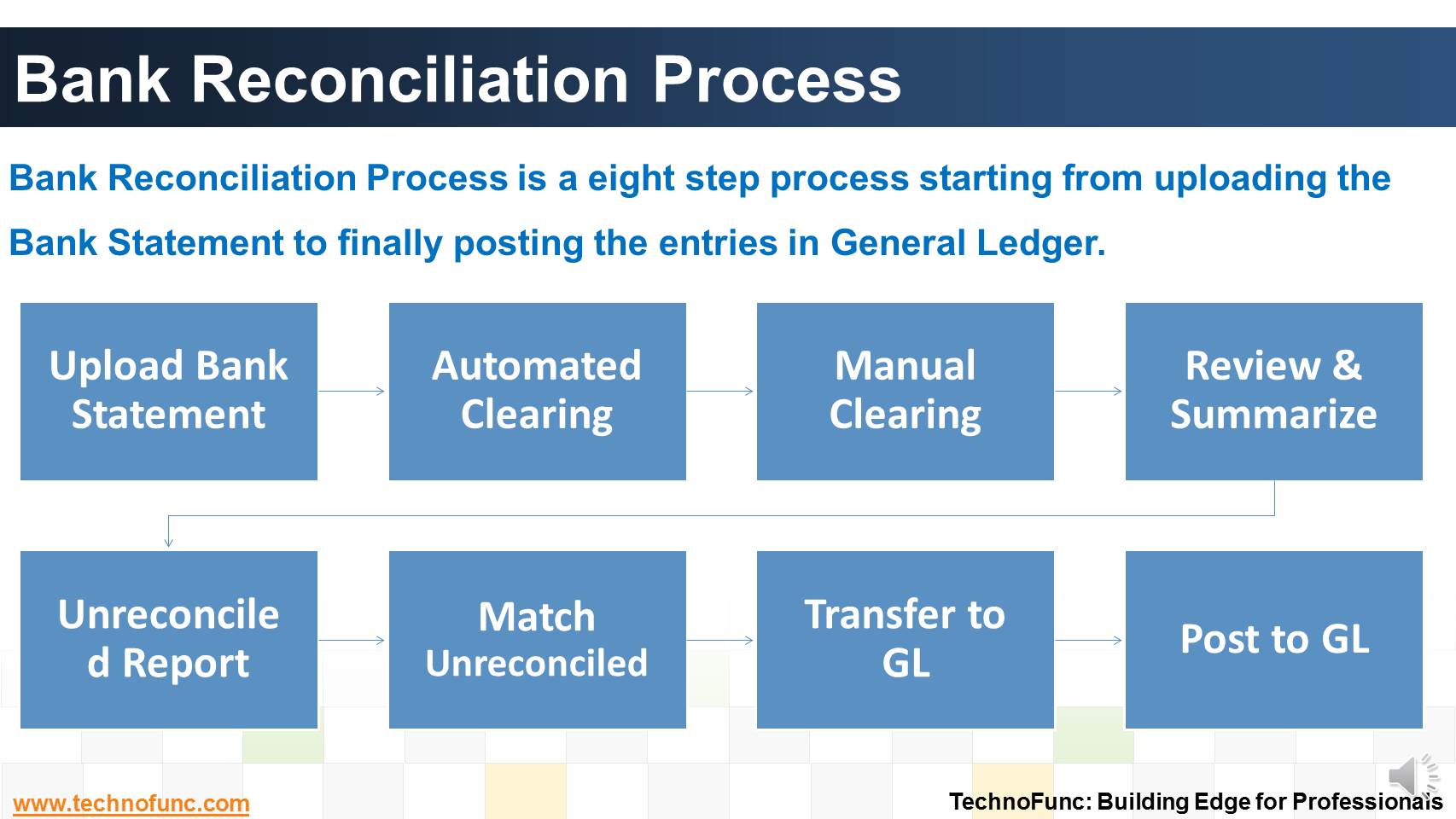

Bank Reconciliation Process is a eight step process starting from uploading the Bank Statement to finally posting the entries in General Ledger. Learn the Eight Steps in Detail!

Bank Reconciliation Process

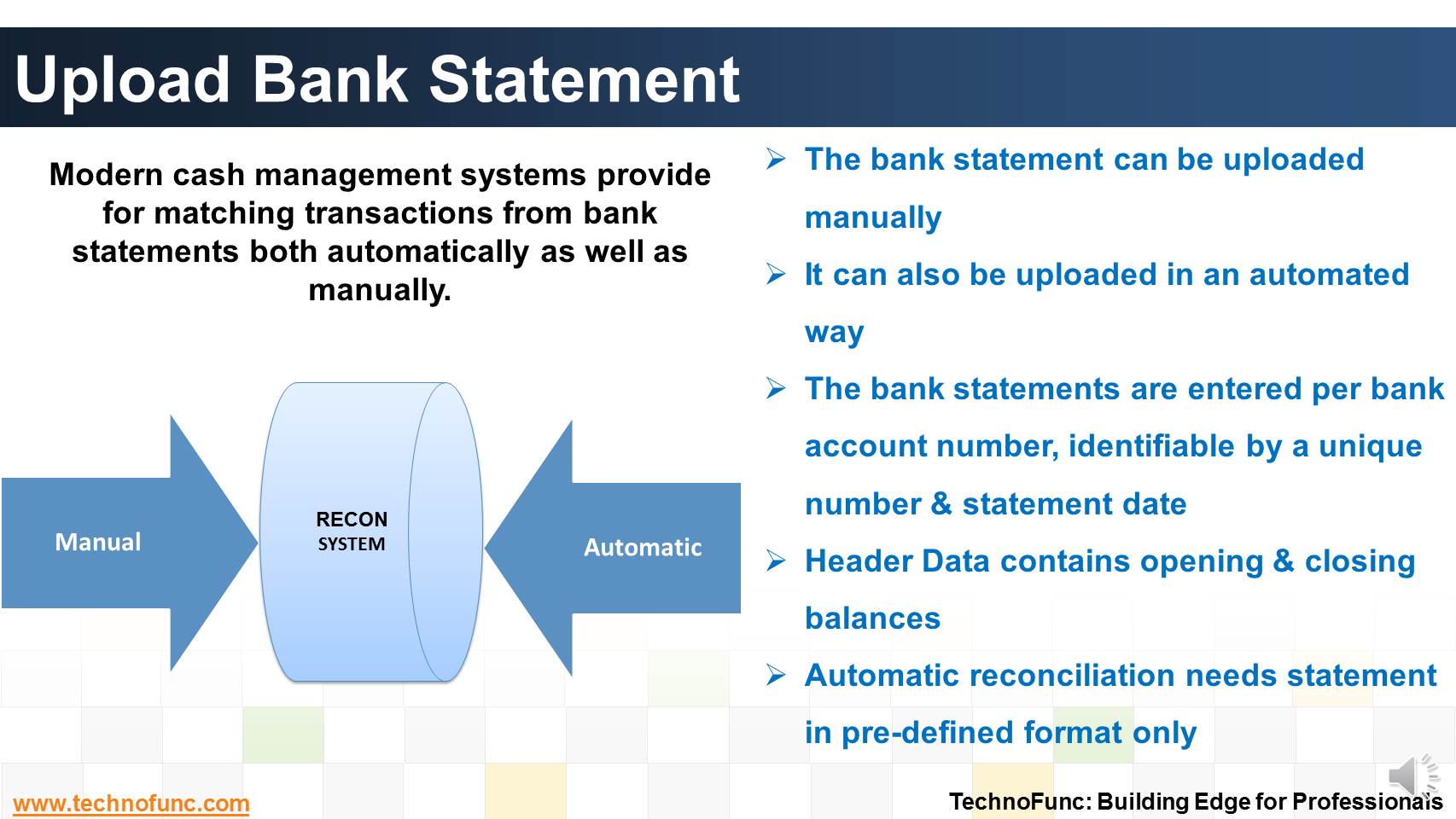

Step 1 is to Upload the Bank Statement

The bank statement can be either uploaded manually or in an automated way if available in the desired electronic formats. The bank statements entered are per bank account number and are identifiable by a unique number and statement date provided by the user.

In the header data, Bank statement opening balances and closing balances are provided before creating the bank statement that acts as a control check to ensure all transactions have been uploaded properly.

For the process of automatic bank reconciliation, generally the system requires electronic bank statement in a pre-defined format only.

Step 2 is to Reconcile with Bank Statement using Automated Clearing

Where Bank statement details are automatically matched and reconciled with system transactions.

This method is ideally suited for bank accounts that have a high volume of transactions.

Step 3 is the Manual Clearing

You use the manual reconciliation method to reconcile any bank statement details that could not be reconciled automatically.

Step 4 is to Review & Summarize

Once the reconciliation process, is complete a review of reconciliation results must be carried out. Generate various reports to support this process of review.

Step 5 is to generate Unreconciled Report

Generate a report with list of all un-reconciled entries, for further decision making and matching.

Step 6 is to Match Unreconciled Entries

Unmatched entries as reported by unreconciled report are to be investigated and matched manually. Open items in clearing account will be cleared to respective customer / vendor account after getting information from bank/ other sources.

The entries that still remain unmatched should to be manually transferred to "Unreconciled Account".

Step 7 is to Transfer to General Ledger

After the reconciliation process, the accounting entries generated will be passed to the general ledger. The receipt and payment entries will be transferred in to the actual Cash/Bank account in the General Ledger when posted.

Step 8 is to Post Entries in General Ledger

Once transferred to General Ledger, the next step is to makes the postings to the bank account, bank clearing account along with the payment clearing. The posting can be done for each journal or for the batch.

Related Links

You May Also Like

-

Disbursement Float is the time taken from payment creation to settlement. Collection float is the sum total of time taken by Payment Float; Mail Float; Processing Float and Availability Float. Learn more!

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

Many different accounts are used in finance. Understand the representation and nature of clearing account in context of accounting, finance and ERP Systems.

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

Treasury has increasingly become a strategic business partner across all areas of the business, adding value to the operating divisions of the company. Managing activities that were traditionally carried out within the general finance function. Learn about the drivers for this change.

-

The topic for this lesson is "Introduction to Cash Management Process". We start with the learning objectives for building requisite functional expertise in cash management process.

-

Cash Management - Integrations

Cash Management integrates cash transactions from various sources like Receivables, Payables, Treasury and creates reconciliation accounting entries after matching transactions with Bank Statements.

-

Unravel the mystery behind clearing. Why we use clearing accounts. Find the relevance of word "Clearing" in business context.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

In the previous article we talked about the meaning of the account reconciliations. Now as you now the definition of account reconciliation, in this article let us see why it is carried out.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved