- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Clearing V/s Suspense Account

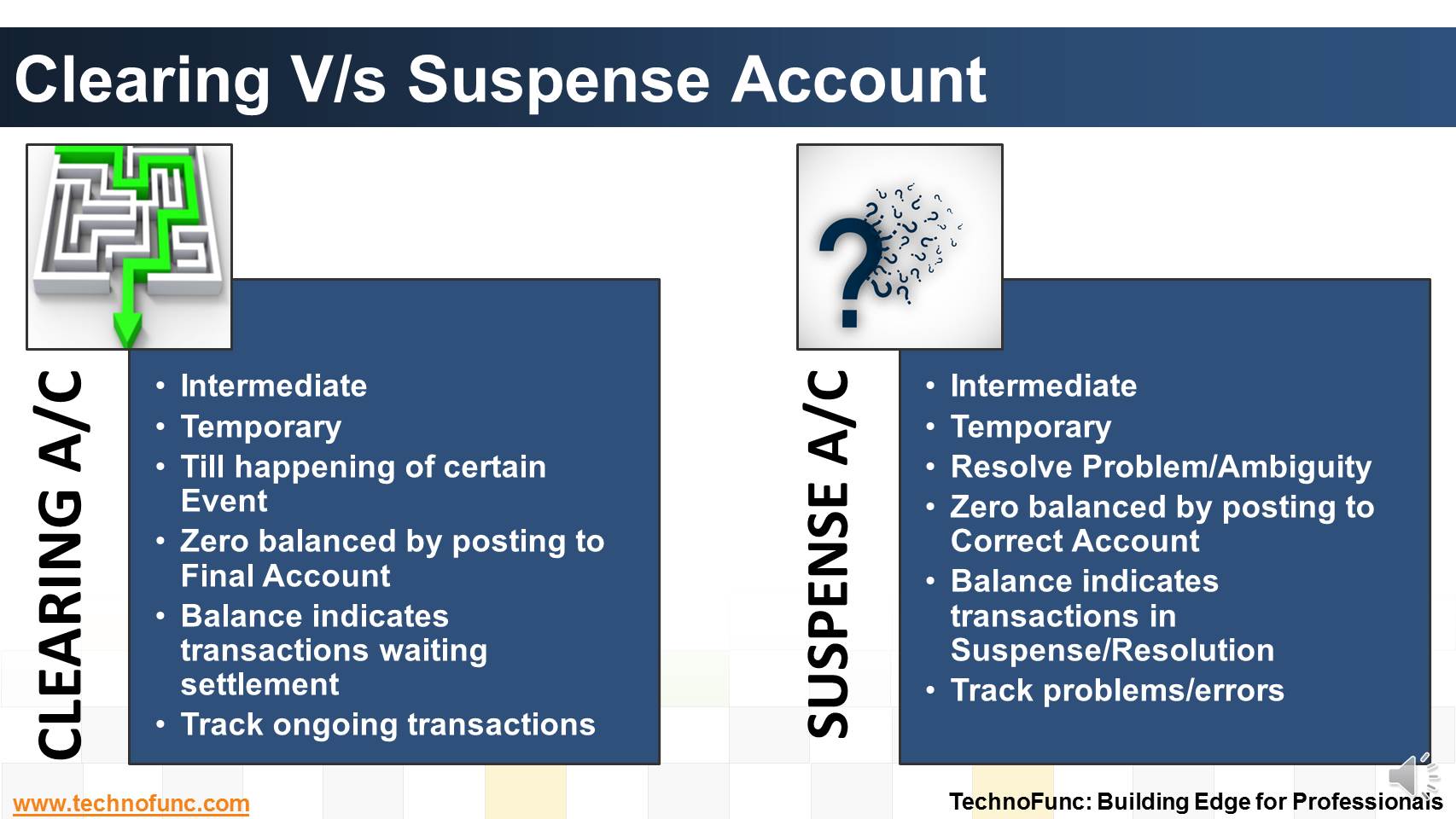

Clearing V/s Suspense Account

Suspense and clearing accounts resemble each other in many respects but there exists important fundamental difference between the two. Read more to explore these differences.

Suspense and clearing accounts resemble each other in many respects but there exists one important fundamental difference.

Both are temporary accounts. Transactions are entered and finally transferred to the appropriate account.

Suspense and clearing accounts have entirely different functions.

Clearing accounts are used to hold transactions for later posting and ensure information is recorded correctly and completely.

A suspense account is used when there appears to be a problem. It serves to record an amount until the problem is resolved.

Both suspense and clearing accounts are "zeroed out" periodically. This means everything in an account is moved to other accounts, leaving a zero balance.

Suspense A/c is used for tracking Uncertainties – to hold transactions when there is some ambiguity involved.

For example, customer has deposited payment in the bank account and you are unable to identify the customer from available information,

You can put the transaction in a suspense account until you determine where it belongs.

Whereas Clearing Accounts are used for tracking transactions on a temporary basis until it's time to post them to a more permanent account.

Taking the same example, now the customer has sent payment against many outstanding invoices and you know it belongs to a particular customer but not to which invoice.

This may be parked in a clearing account until the confirmation is received from customer and amount applied to correct invoice.

Just to keep track of correct outstanding past due invoices.

Related Links

You May Also Like

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

-

In automated clearing, Bank statement details are automatically matched and reconciled with system transactions. Learn how this process works and what are the perquisites to enable the same.

-

The Cash Management component ensures that the enterprise has sufficient liquidity for payments that are due and to monitor payment flows. Learn how treasury plays an important role in cash management for the enterprise.

-

Treasury Management - Benefits

Effectively using treasury management with cash management and trade finance products brings tangible benefits to both corporates and financial institutions. Let us discuss some tangible benefits of treasury function.

-

Learning objectives for this lesson are: Meaning of Order to Cash Process; Sub Processes under Order to Cash; Process Flow for Order to Cash; Key Roles & Transactions; Key Setups/Master Data Requirements.

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Technology has enabled the treasury function by providing various solutions to manage it's complicated tasks. This article explains various types of treasury management systems available in the market.

-

Bank Reconciliation is a PROCESS to Validate the bank balance in the general ledger With Bank Statement. Learn the bank recon process.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved