- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Procure to Pay

- Define Accounts Payable

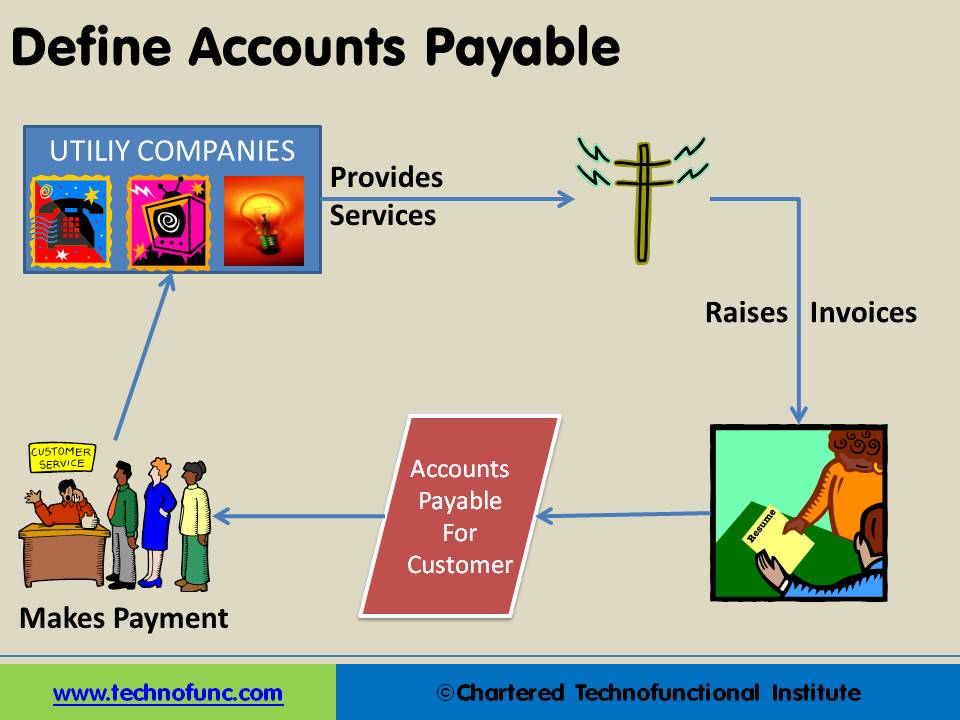

Define Accounts Payable

Payables are often categorized as “Trade Payables” & “Expense Payables”. “Trade Payables” are the monies due for the purchase of physical goods that are recorded in Inventory. “Expense Payables” are the monies due for the purchase of goods or services that are expensed.

How do we define Accounts Payables:

We all use utilities. For example we take various services from the phone company, the gas company and the cable company. They provide us the goods and services first and as the end of the agreed billing period they raise an invoice on the customer. In this case the Utility Company is our Creditor and they have provided us the service on credit. The amount payable to the utility company is the “Account Payable” for us, which needs to be paid in very short-term to the utility company (Supplier/Creditor) to enjoy continued services.

Similarly credit is extended in the normal course of business to the customers on purchase of goods and services and needs to be paid off within a given period of time in order to avoid default.

Payables are often categorized as “Trade Payables” & “Expense Payables”. “Trade Payables” are the monies due for the purchase of physical goods that are recorded in Inventory. “Expense Payables” are the monies due for the purchase of goods or services that are expensed. Common examples of Expense Payables are utilities like telephone and electricity.

Related Links

You May Also Like

-

Subsidiary Ledgers – AP Ledger

An accounts payable invoice gets recorded in the Account Payable sub-ledger at the time an invoice is received and validated that the respective goods corresponding to the invoice have been received. Then it is verified and vouchered for payment as per the payment terms agreed with the Supplier.

-

The Outbound process starts with routing the shipments. The Outbound execution process starts from the point when pick tasks are completed for an outbound shipment and ends at the point where the outbound packages are loaded into trailers. The Warehouse Outbound process includes managing and controlling outgoing materials starting from the download of orders through to the shipping of products from the warehouse.

-

We need a strong payables process so that it provides us with a high-productivity accounting solution to process vendor payments. An integrated payables process provides strong financial control so you can prevent duplicate payments, pay for only the goods and services you order and receive, and maximize supplier discounts. Understand the key features of an effective accounts payable system.

-

After products have been received and passed a quality inspection, they need to be stored so that you can find them when you need them. This process is called putaway. The spot where you store a particular product is called a location. One section of a warehouse might have small locations for light items; another area may have large locations on the floor for heavy items.

-

Types of Inventory Count Processes

While dealing with lots of inventory in a warehouse, lots of things can go wrong. Shipments may not have the right number of units in them, or they could get damaged somewhere along the supply chain. Discrepancies in the stock may arise as part of every inventory control, and need to be corrected immediately after the inventory control procedure has been finished.

-

Inventory is money, and hence businesses need to perform physical inventory counts periodically to make sure that their inventory records are accurate. The traditional approach to conducting inventory counts is to shut down a facility during a slow time of year to count everything, one item at a time. This process is slow, expensive, and (unfortunately) not very accurate.

-

When products arrive at a facility, there need to be a defined process to let them in. The process for accepting inventory when it arrives is called "Receiving". Any warehousing operation must be able to receive inventory or freight from trucks at loading docks and then stow them away in a storage location. Receiving often involves scheduling appointments for deliveries to occur, along with unloading the goods and performing a quality inspection.

-

In the normal course of business, customers are likely to return orders from time to time due to various reasons and business should design processes the manage and accept such returns. A well designed returns management process can reduce costs and issues associated with returns or exchanges.

-

Large companies have huge number of suppliers. To remain competitive they need to manage their procure to pay process very effectively. They create specialized division to handle these operations.

-

Understand what we mean by accounts payable. Why the process is called accounts payable and what are the other names by which this process is known as. Download a ready recokner to keep with you.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved