- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- General Ledger (Record to Report)

- GL - Review & Approve Journals

GL - Review & Approve Journals

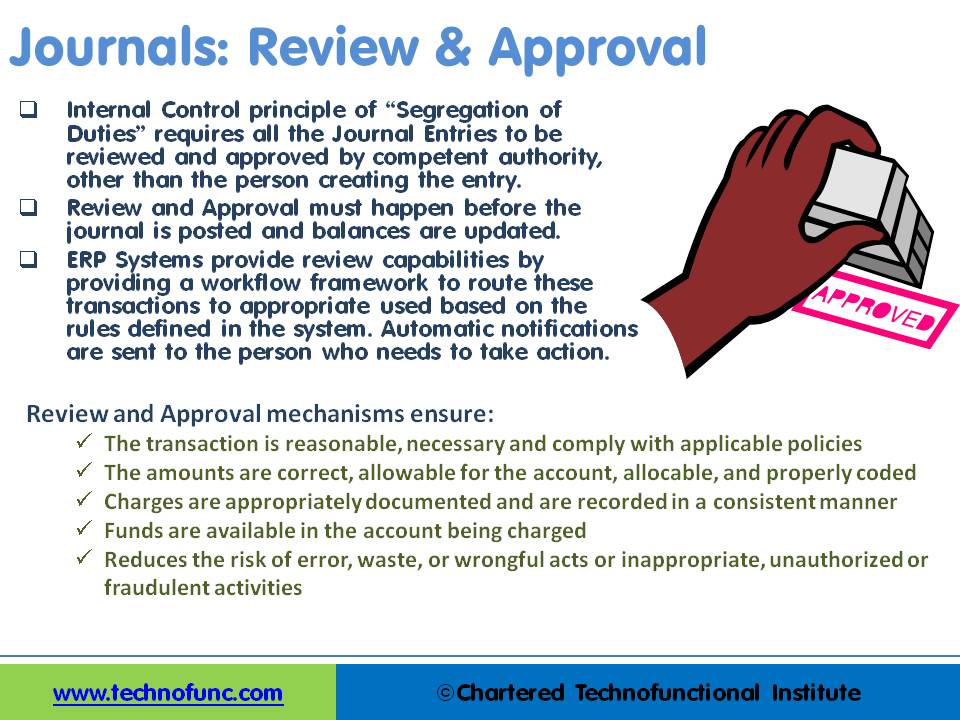

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

What is Internal Control?

Internal control plays an important role in the prevention and detection of fraud and errors to ensure the accuracy of financial results. Internal control is the process designed to ensure reliable financial reporting, effective and efficient operations, and compliance with applicable laws and regulations. This needs to be supplemented by an effective control environment that ensures that established policies and procedures are followed.

What are the principles of Internal Control?

Management defines specific policies and procedures to achieve its objectives and run the day to day operations in the organization. The most important control activities involve segregation of duties, proper authorization of transactions and activities, adequate documents and records, physical control over assets and records, and independent checks on performance. These controls and checks ensure that financial statements are complete and accurate.

Principle 1: Segregation of Duties:

The internal control principle of segregation of duties requires that different individuals be assigned responsibility for different elements of related activities, particularly those involving authorization, custody, or recordkeeping. Some examples in the context of general ledger transactions are; the same person who is responsible for recording a transaction should not be responsible for posting the same in the general ledger. The recorded transaction should be checked and reviewed by someone else as having different individuals perform these functions creates a system of checks and balances.

Principle 2: Authorization of Transactions:

Proper authorization of transactions and activities helps ensure that all company activities adhere to established guidelines unless responsible managers authorize exceptions granting another course of action. In the context of the general ledger for example, Journals with different levels of amounts should go to various officers in the company for official authorization before they can be posted in General Ledger. Another example could be that any journal necessitating a debit to Revenue Account must be approved by the accounts manager before it can be posted, to allow the accounts manager to authorize and verify the reversal of revenue.

Principle 3: Adequate Documentation & Physical Control:

Adequate documents and records provide evidence that financial statements are accurate and based on genuine business transactions pertaining to the entity. Controls designed to ensure adequate recordkeeping include the creation of journals and other supporting documents that are easy to use and sufficiently informative. Document sequencing is another functionality that is used to pre-number consecutive journals. It is also very important to document the review and approval process to make it available for audit staff subsequently. The simplest way to do this is to print out the journal entries and have the reviewer initial them. This should then be saved as support. In the automated general ledgers, each user is associated with a user id and transactions can flow to the reviewer and approver before posting and a system audit trail is sufficient audit evidence if such a process has been established.

Physical control over assets and records helps protect the company's assets. These control activities may include electronic or mechanical controls. Journals should be physically safeguarded in case they are on paper and guarded with access privileges & established backup and recovery procedures in case of automated systems.

What is the need for Journal Review and Approval?

Under the Sarbanes-Oxley Act, companies are required to perform a fraud risk assessment and assess related controls. This typically involves identifying scenarios in which theft or loss could occur and determining if existing control procedures effectively manage the risk to an acceptable level. The risk that senior management might override important financial controls to manipulate financial reporting is also a key area of focus in fraud risk assessment. Top managers of publicly held companies must sign a statement of responsibility for internal controls and include this statement in their annual report to stockholders. Review and approval in the accounting process are independent checks on performance, which are carried out by employees who did not do the work being checked. These processes help ensure the reliability of accounting information and the efficiency of operations. Internal auditors and external auditors rely on established processes to gaze at the extent of their audit procedures.

Having the journal review and approval process in place ensures that all general journal entries get reviewed. This review is done to help prevent errors such as adjusting the wrong accounts and transposing numbers. It also helps protect against fraud by making sure there is a valid reason for the journal entry and someone is not manipulating the accounts for vested interests.

1. Review Transactions/Edit Transactions:

The transactions can be reviewed for accuracy and completeness once they have been entered into the automated accounting system. If a review is done by another person who is not responsible or involved in recording the transaction it can help to ensure that financial information in the journals accurately reflects actual activity.

A review of transactions is done to ensure that the transaction is within the guidelines of the purpose of the accounts used and is appropriately charged to the account following the concepts defined in the accounting equation. In the case of manual journals, one must ensure that the transaction is consistent with available supporting documents. If any errors are found in the transaction, they can be edited and corrected at this stage.

2. Journal Approval:

In the case of journal recording the journal entered by one person needs to be approved by another person in this step. This ensures having more than one person to complete the “Journal Creation Task”. In GL the separation by getting the financial transaction approved by more than one individual prevents fraud and error.

3. Journal Approval Workflow:

Automated accounting systems provide you with the functionality of sending the journals for approval to the designated person. The system will validate the journal batch, determine if approval is required, and submit the batch to approvers (if required), then notifies appropriate individuals of the approval results. Review and Approval must happen before the journal is posted and balances are updated.

ERP Systems provide review capabilities by providing a workflow framework to route these transactions to appropriate users based on the rules defined in the system. Automatic notifications are sent to the person who needs to take action.

Benefits of Journal Review and Approve:

Review and Approval mechanisms ensure:

- The transaction is reasonable, necessary, and complies with applicable policies

- The amounts are correct, allowable for the account, allocable, and properly coded

- Charges are appropriately documented and are recorded in a consistent manner

- Funds are available in the account being charged

- Reduces the risk of error, waste, or wrongful acts or inappropriate, unauthorized, or fraudulent activities

Related Links

You May Also Like

-

Operational Structures in Business

Large organizations grow through subsidiaries, joint ventures, multiple divisions and departments along with mergers and acquisitions. Leaders of these organizations typically want to analyze the business based on operational structures such as industries, functions, consumers, or product lines.

-

GL - Recurring Journal Entries

A “Recurring Journal” is a journal that needs to be repeated and processed periodically. Recurring Entries are business transactions that are repeated regularly, such as fixed rent or insurance to be paid every month. Learn the various methods that can be used to generate recurring journals. See some examples and explore the generic process to create recurring journals in any automated system.

-

GL - Accrued / Unbilled Revenue

Accrued revenues (also called accrued assets) are revenues already earned but not yet paid by the customer or posted to the general ledger. Understand what we mean by the terms accrued revenue, accrued assets, and unbilled revenue. Explore the business conditions that require recognition of accrued revenue in the books of accounts and some industries where this practice is prevalent.

-

Shared Services is the centralization of service offering at one part of an organization or group sharing funding and resourcing. The providing department effectively becomes an internal service provider. The key is the idea of 'sharing' within an organization or group.

-

Five Core General Ledger Accounts

Typically, the accounts of the general ledger are sorted into five categories within a chart of accounts. Double-entry accounting uses five and only five account types to record all the transactions that can possibly be recorded in any accounting system. These five accounts are the basis for any accounting system, whether it is a manual or an automated accounting system. These five categories are assets, liabilities, owner's equity, revenue, and expenses.

-

After reading this article the learner should be able to understand the meaning of intercompany and different types of intercompany transactions that can occur. Understand why intercompany transactions are addressed when preparing consolidated financial statements, differentiate between upstream and downstream intercompany transactions, and understand the concept of intercompany reconciliations.

-

A Company (also called corporation) may be understood as an association of persons in which money is contributed by them, to carry on some business or undertaking. Persons who contribute the money are called the shareholders or the members of the company. A corporation is an artificial being, invisible, intangible and existing only in contemplation of law. Being the mere creature of law, it possesses only those properties which the charter of its creation confers upon it.

-

In some of the ERP tools, there are more than 12 accounting periods in a financial year. This article discusses the concept of accounting calendar and accounting periods. Learn why different companies have different accounting periods. Understand some of the commonly used periods across different organizations and the definition & use of an adjustment period.

-

GL - Review & Approve Journals

Review and Approval mechanisms ensure that the accounting transaction is reasonable, necessary, and comply with applicable policies. Understand why we need review and approval processes, what are they, and how they are performed in automated general ledger systems. Learn the benefits of having journal approval mechanisms in place.

-

Prepayments and Prepaid Expenses

Prepayments are the payment of a bill, operating expense, or non-operating expense that settle an account before it becomes due. Learn the concept of prepaid expenses. Understand the accounting treatment for prepaid expenses. Understand the concept by looking at some practical examples and finally learn the adjusting entry for these expenses.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved