- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Business Processes

- Cash Management

- Manual Clearing

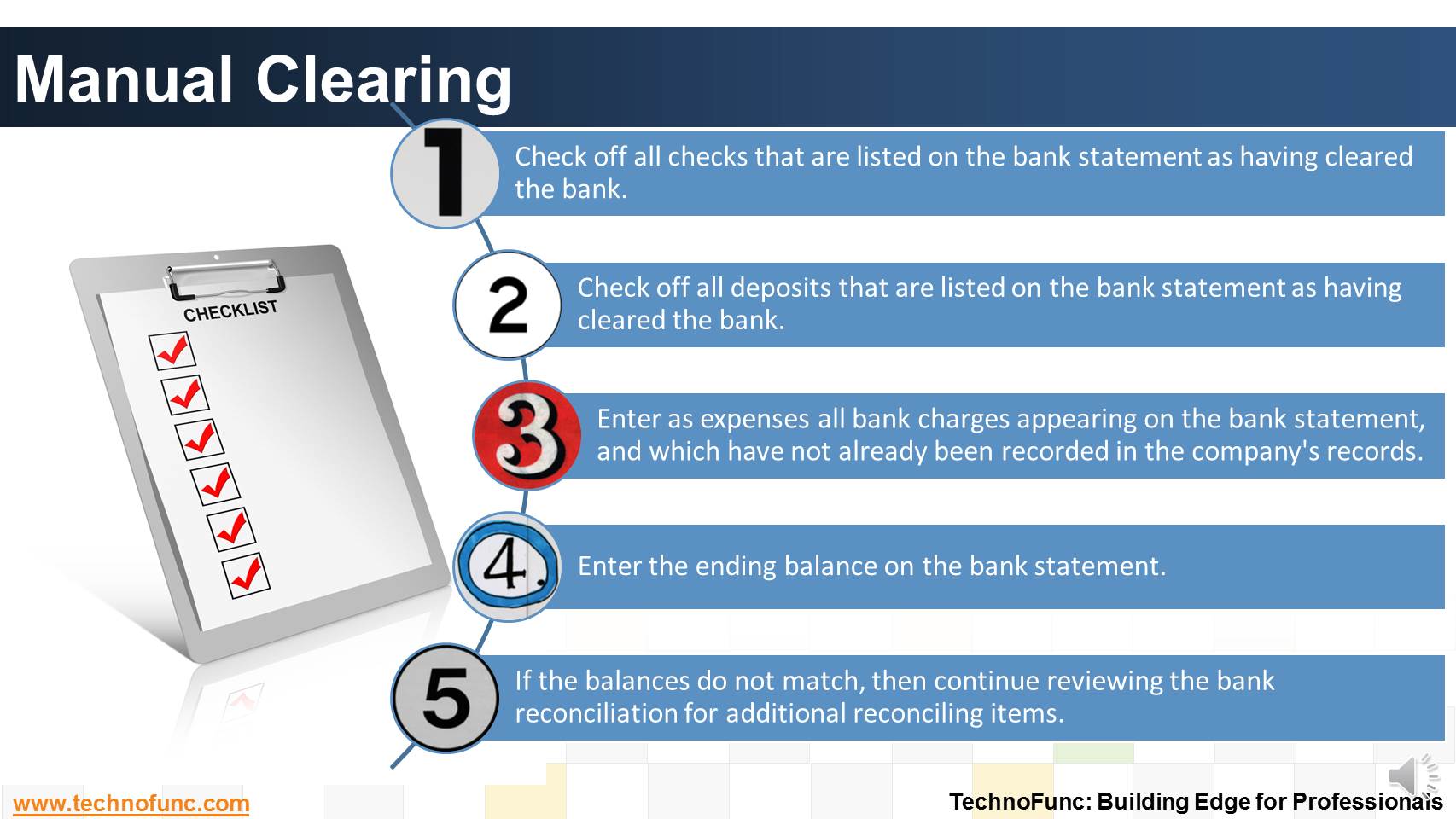

Manual Clearing

In manual clearing, Bank statement details are to be matched manually considering certain rules. Learn the steps involved in manual clearing of bank transactions.

Manual Clearing

This method requires you to manually match bank statement details with system transactions.

The method is ideally suited to reconciling bank accounts that have a small volume of monthly transactions.

You need to also use the manual reconciliation method to reconcile any bank statement details that could not be reconciled automatically.

Steps in Manual Clearing

- Check off all checks that are listed on the bank statement as having cleared the bank.

- Check off all deposits that are listed on the bank statement as having cleared the bank.

- Enter as expenses all bank charges appearing on the bank statement, and which have not already been recorded in the company's records.

- Enter the ending balance on the bank statement.

- If the balances do not match, then continue reviewing the bank reconciliation for additional reconciling items.

Related Links

You May Also Like

-

Effectively using cash management with trade finance products brings tangible benefits to both corporates and financial institutions.Learn the various benefits of cash management process.

-

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Till reconciliation happens the amounts are parked in 'Cash Clearing Account'.

-

Although there is no straight forward answer to the question, how to best organize a treasury function, this article provides an generic view of the way large MNCs creates departments or sub-functions within the treasury function.

-

The objective of funding Management is to implement strategies that lead to the best borrowing rates and lower investment costs. Learn how treasury aids in loans and investment management functions.

-

Account Reconciliation – How? Learn the three key attributes to perfom account reconciliation.

-

Why enterprises need cash management. What is the purpose of having a well defined cash management process?

-

Introduction to Cash Clearing Process

Unravel the mystery behind clearing accounts. Learn why clearing accounts are used in finance and accounting. Learn why so many clearing accounts are defined in ERPs and Automated Accounting Systems.

-

The terms Treasury Management and Cash Management are sometimes used interchangeably, while, in fact, the scope of treasury management is larger and includes funding and investment activities as well. Learn all about Treasury Management here!

-

Cash Clearing – Accounting Entries

The Cash Clearing process enables you to track amounts that have actually cleared your bank. Learn the steps and accounting entries that gets generated during the cash clearing process.

-

Have you ever wondered what is actually a Bank Statement and why it is needed. What is the information that is available in a bank statement?

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved