- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Domain Knowledge

- Insurance Domain

- Insurance Glossary

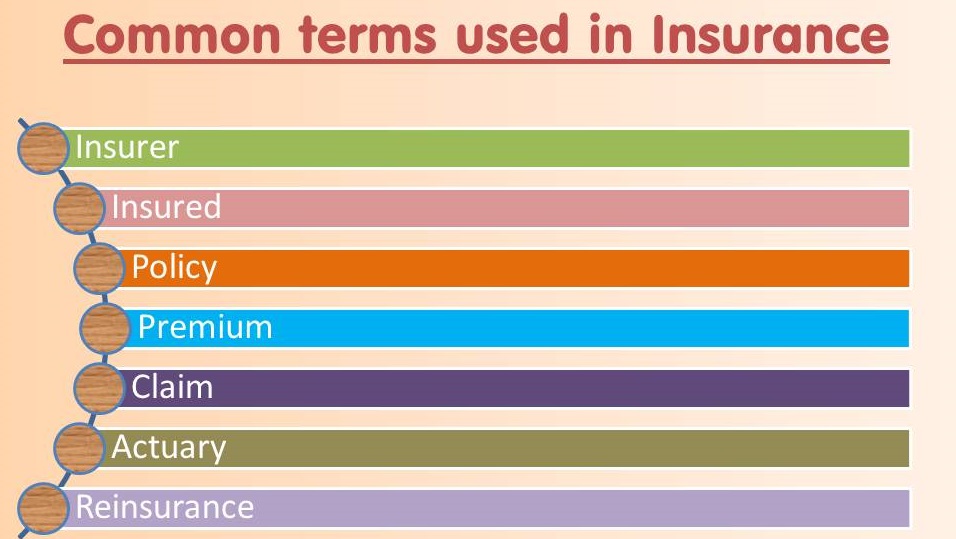

Insurance Glossary

An article to explain key terms used in the Insurance Industry and Insurance Business. Also, learn about various operational and performance metrics used in the insurance domain. Learn the definition and meaning of insurance industry terms like insured, insurer, claim, reinsurance, policy, and policy premium, etc.

Insurance Industry - Key terms and their definitions:

Let us understand some common terms used in the context of the insurance business.

Insurer :

The company which issues insurance policy is called insurer. The insurer is the party to an insurance arrangement who undertakes to indemnify for losses. The insurer agrees to pay compensation on the happening of uncertain and unfortunate events.

Insured :

The person, group, or property for which an insurance policy is issued is called Insured. The person who is protected against uncertain losses and who is paid compensation by the insurance company is called insured. Insured is also known as the policyholder.

Policy :

It’s a written document that contains the contract of Insurance. It’s a document given by the insurance company to the policyholder, which defines the terms and conditions of the policy taken. This is an important document that needs to be produced by the policyholder to initiate any claims.

Premium :

Premium is the periodic financial consideration paid by the insured to the insurance company in return for the insurers' guarantee to compensate for his losses in the future. The amount of premium depends on the policy amount and the cover period. The amount of premium to be paid is generally calculated in the beginning and remains the same throughout the entire policy period.

Claim :

A formal request by the insured to an insurance company asking for a payment based on the terms of the insurance policy. Insurance claims are reviewed by the company for their validity and then paid out to the insured. The claim is made on the happening of the event. For example, fire, flood, theft, death, etc.

Actuary :

An actuary is a professional person appointed by an insurance company that deals with the financial impact of risk and uncertainty. An actuary is a highly trained statistician with expertise in evaluating various types of risks. An actuary is a specialist mathematician who calculates premiums for insurance companies.

Reinsurance :

When multiple insurance companies share risk by purchasing insurance policies from other insurers to limit the total loss the original insurer would experience in case of disaster. When reinsurance occurs, the premium paid by the insured is typically shared by all of the insurance companies involved. This is done to protect the company from the heavy losses in case of a big tragedy. This is generally considered for high-value items for example satellites, ships, etc.

Related Links

You May Also Like

-

Insurance is categorized based on risk, type, and hazards. Logically, any risk that can be quantified can potentially be insured. Understand the importance of insurance and the different types of insurances like Life Insurance or Personal Insurance, Property Insurance, Marine Insurance, Fire Insurance, Liability Insurance, Guarantee Insurance.

-

An article to explain key terms used in the Insurance Industry and Insurance Business. Also, learn about various operational and performance metrics used in the insurance domain. Learn the definition and meaning of insurance industry terms like insured, insurer, claim, reinsurance, policy, and policy premium, etc.

-

A primary insurer purchases reinsurance to limit its exposure, usually to one specific type of risk, thereby diversifying its book of risk. Businesses in this industry focus on assuming all or part of the risk associated with existing insurance policies originally underwritten by direct insurance carriers. In other words, the primary activity of this industry is insuring insurance companies. Reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers.

-

The Business Model of Insurance Industry

The insurance industry business model can be further categorized into two types of main activities, service domain, and support domain. Service domain activities make up the company's value chain and the support domain provides the infrastructure and support to sustain the value chain. Support activities may include corporate services, finance, human resources, or information systems, and technology.

-

What is Finance? Meaning, Definition & Features of Finance

Finance is the science around the management of money. Finance encompasses banking, credit, investments, assets, and liabilities. The finance function encompasses a variety of functions, activities, and processes. Finance also consists of financial systems. Acquisition, allocation, utilization, and channelizing the funds to maximize the shareholder's wealth. Finance includes public, personal, and corporate finance.

-

The insurance industry comprises companies and people who develop insurance policies and sell, administrate, and regulate them. Insurance is a means of protection from financial loss. It is a form of risk management primarily used to hedge against the risk of a contingent, uncertain loss. The insurance Industry manages the risk to people and businesses from the dangers of their current circumstances. Insurance policies are a safeguard against the uncertainties of life.

-

What is General Insurance Industry?

General Insurance industry providers perform an essential function in today's economy. General insurance is typically defined as any insurance that is not determined to be life insurance. Depending on the type of occupation, risk exposure, and the money involved, the insurance could be different for each industry or business. In underwriting insurance policies, general insurers earn premiums that they further invest.

-

Parties in the Contract of Insurance

There are two parties in the contract of Insurance. Understand these parties and their definition in the contract of insurance. Learners will learn about the key stakeholders in the insurance business along with a classification of internal and external stakeholders.

-

BFSI is an acronym for Banking, Financial Services, and Insurance and popular as an industry term for companies that provide a range of such products/services and is commonly used by IT/ITES/BPO companies and technical/professional services firms that manage data processing, application testing, and software development activities in this domain. Banking may include core banking, retail, private, corporate, investment, cards, and the like. Financial Services may include stock-broking, payment gateways, mutual funds, etc. The insurance covers both life and non-life.

-

This article helps the student to understand the legal principles and provisions of the insurance law. Starting with the fundamentals from which law is derived, this article helps the student to understand the salient aspects of any insurance contract, the rights and obligations of parties to the contract, and the legal environment within which insurance practice is carried out. Explore the seven most important principles of insurance.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved