- Home

- Business Processes

- Industry Knowledge

- Aerospace Industry

- Automotive Industry

- Banking Domain

- BFSI Industry

- Consumer/ FMCG Industry

- Chemicals Industry

- Engineering & Construction

- Energy Industry

- Education Domain

- Finance Domain

- Hospitality Domain

- Healthcare Industry

- Insurance Domain

- Retail Industry

- Travel and Tourism Domain

- Telecom Industry

- Leadership Skills

- eLearning

- Home

- Domain Knowledge

- BFSI Industry

- Principles of Insurance

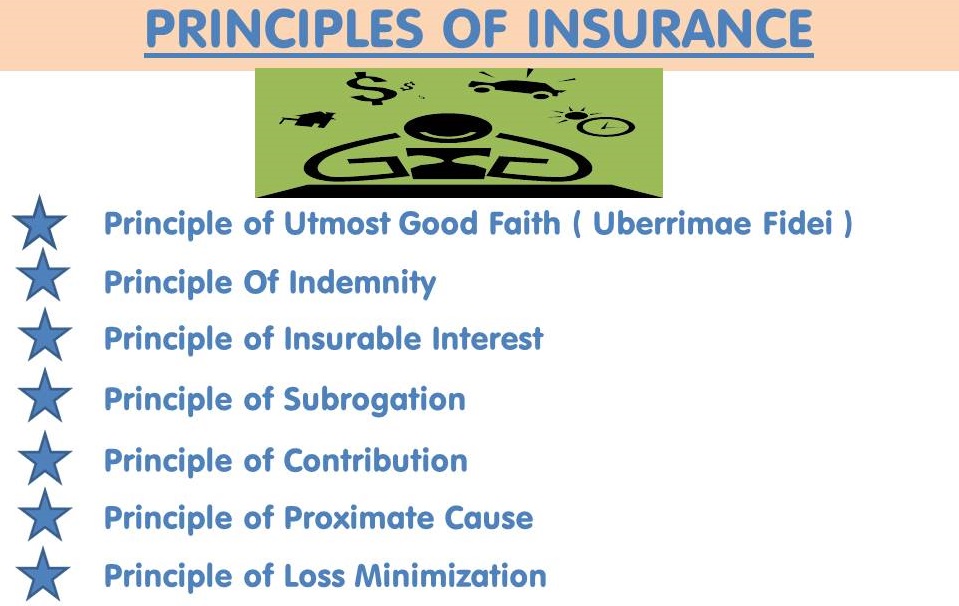

Principles of Insurance

This article helps the student to understand the legal principles and provisions of the insurance law. Starting with the fundamentals from which law is derived, this article helps the student to understand the salient aspects of any insurance contract, the rights and obligations of parties to the contract, and the legal environment within which insurance practice is carried out. Explore the seven most important principles of insurance.

Every insurance policy involves a contractual relationship between the insurer and the insured. This article helps the student to understand the legal principles and provisions of the insurance contracts. Starting with the sources from which law is derived, the article takes the students through the salient aspects of any insurance contract, the rights and obligations of both parties to the contract, and the legal environment within which insurance practice is carried out. These principles are the essentials or requirements of insurance irrespective of the type of insurance concerned. There are seven fundamental principles of Insurance:

What is Insurance Law?

Insurance law is the name given to practices of law surrounding insurance, including insurance policies and claims. It can be broadly broken into three categories - regulation of the business of insurance; regulation of the content of insurance policies, especially with regard to consumer policies; and regulation of claim handling. At common law, the defining concept of a contract of commercial insurance is of a transfer of risk freely negotiated between counterparties of similar bargaining power, equally deserving (or not) of the court's protection.

In civil law countries insurance has typically been more closely linked to the protection of the vulnerable, rather than as a device to encourage entrepreneurialism by the spreading of risk. Civil law jurisdictions - in very general terms - tend to regulate the content of the insurance agreement more closely, and more in the favor of the insured, than in common law jurisdictions, where the insurer is rather better protected from the possibility that the risk for which it has accepted a premium may be greater than that for which it had bargained. As a result, most legal systems worldwide apply common-law principles to the adjudication of commercial insurance disputes, whereby it is accepted that the insurer and the insured are more-or-less equal partners in the division of the economic burden of risk.

Discussed below are some generally accepted principles of Insurance:

Principle1: Principle of Utmost Good Faith:

The principle of Utmost Good Faith is the primary principle of insurance. The doctrine of uberrimae fides - utmost good faith - is present in the insurance law of all common law systems. An insurance contract is a contract of utmost good faith. The most important expression of that principle, under the doctrine as it has been interpreted in England, is that the prospective insured must accurately disclose to the insurer everything that he knows and that is or would be material to the reasonable insurer.

Something is material if it would influence a prudent insurer in determining whether to write a risk and if so upon what terms. If the insurer is not told everything material about the risk, or if a material misrepresentation is made, the insurer may avoid (or "rescind") the policy, i.e. the insurer may treat the policy as having been void from inception, returning the premium paid.

In a nutshell, a higher degree of honesty is imposed on an insurance contract than is imposed on other contracts. Honesty is mainly imposed on insurance applicants. It is supported by three legal doctrines; Representation, Concealment & Warranty. According to this principle, the insurance contract must be signed by both parties (insurer and insured) in an absolute good faith or belief or trust. Both parties in the contract must disclose all material facts for the benefit of each other. False information or non-disclosure of any important fact makes the contract voidable.

Principle2: Principle of Insurable Interest:

The person getting an insurance policy must have an insurable interest in the property or life insured. A person is said to have an insurable interest in the property if he is benefited by its existence and be prejudiced by its destruction. The presence of insurable interest is a legal requirement. So an insurance contract without the existence of insurable interest is not legally valid and cannot be claimed in a Court. The object of this principle is to prevent insurance from becoming a gambling contract.

Most common law jurisdictions require the insured to have an insurable interest in the subject matter of the insurance. An insurable interest is that legal or equitable relationship between the insured and the subject matter of the insurance, separate from the existence of the insurance relationship, by which the insured would be prejudiced by the occurrence of the event insured against, or conversely would take a benefit from its non-occurrence.

Insurable interest was long held to be morally necessary for insurance contracts to distinguish them, as enforceable contracts, from unenforceable gambling agreements (binding "in honor" only) and to quell the practice, in the seventeenth and eighteenth centuries, of taking out life policies upon the lives of strangers. In the case of life insurance policies, insurable interest must exist at the time of policy inception, but not at the time of a loss (death).

The intent behind this principle is that the insured must be in a position to financially suffer if a loss occurs. This principle helps in preventing gambling by way of taking insurance on a property and waiting for a loss occur. In the case of life insurance contracts, it reduces moral hazard whereby a person takes life insurance on a person and prays for his/her death for insurance proceeds.

Principle3: Principle of Indemnity:

The essence of insurance is the principle of indemnity that the person who suffers a financial loss is placed in the same financial position after the loss as before the loss occurred. He neither profits nor is disadvantaged by the loss. In practice, this is much more difficult to achieve in life insurance than in property insurance. No life insurance company would provide insurance in an amount clearly exceeding the estimated economic value of the covered life. Limiting the amount of life insurance sold to reflect economic value gives recognition to the rule of indemnity. Additionally, only persons exposed to the potential loss may legitimately own the insurance covering the insured’s life.

The principle of indemnity is applicable to all types of insurance policies except life insurance. Indemnity means security, protection, and compensation given against damage, loss, or injury. The insurer promise to help the insured in restoring the financial position before the loss has occurred. Whenever there is a loss of property, the loss is compensated. The compensation payable and the loss suffered should be measurable in terms of money. The insured will be compensated only up to the amount of loss suffered by him. He will not earn profit from the contractor. The maximum amount of compensation will be up to the value of the policy which is fixed at the time of contract. The courts rely upon the principle of indemnity to hold that an insured may not recover more than his true loss.

Principle4: Principle of Subrogation:

Subrogation means substituting one creditor for another. The principle of Subrogation is an extension and another corollary of the principle of indemnity. It also applies to all contracts of indemnity. According to the principle of subrogation, when the insured is compensated for the losses due to damage to his insured property, then the ownership right of such property shifts to the insurer. It must be clarified here that the insurer's right of subrogation arises only when he has paid for the loss for which he is liable under the policy and this right extend only to the rights and remedies available to the insured in respect of the thing to which the contract of insurance relates. The principle of subrogation is applicable to all insurance other than life insurance. If the insured party gets compensation for the loss suffered by him, he cannot claim the same amount of loss from any other party. It prevents the insured from being indemnified from two sources in respect of the same loss.

Hence this principle of subrogation provided for substitution of the insurer in place of the insured for the purpose of claiming indemnity from a third party wrongdoer for a loss paid by the insurer. This helps in preventing collecting twice by the insured, to hold the negligent party responsible, and to bring down insurance rates.

Principle5: Principle of Contribution:

Sometimes a property is insured with more than one company. The insured cannot claim more than the total loss from all the insurance companies put together. He cannot claim the same loss from different insurance companies. If one insurer pays full compensation then that insurer can claim proportionate claim from the other insurers. A person cannot be restored to a better position than before the loss occurred. The total loss suffered by the insured will be contributed by different companies in proportion to the value of policies issued by them.

The principle of Contribution is a corollary of the principle of indemnity. It applies to all contracts of indemnity if the insured has taken out more than one policy on the same subject matter. According to this principle, the insured can claim the compensation only to the extent of actual loss either from all insurers or from any one insurer. If one insurer pays full compensation then that insurer can claim proportionate claim from the other insurers.

Principle6: Principle of Proximate Cause:

Principle of Proximate Cause means when a loss is caused by more than one cause, the proximate or the nearest or the closest cause should be taken into consideration to decide the liability of the insurer. This principle is found very useful when the loss occurred due to a series of events. The principle states that to find out whether the insurer is liable for the loss or not, the proximate (closest) and not the remote (farthest) must be looked into.

However, in the case of life insurance, the principle of Proximate Cause does not apply. Whatever may be the reason for death the insurer is liable to pay the amount of insurance.

Under this rule, in order to determine whether a loss resulted from a cause covered under an insurance policy, a court looks for the predominant cause which sets into motion the chain of events producing the loss, which may not necessarily be the last event that immediately preceded the loss.

Principle7: Principle of Loss Minimization:

According to the Principle of Loss Minimization, the insured must always try his level best to minimize the loss of his insured property, in case of sudden events like fire, etc. The insured must take all necessary steps to control and reduce the losses and to save what is left. This principle makes the insured more careful in respect to this insured property, just as any prudent person would do in those circumstances. If he does not do so, the insurer can avoid the payment of loss attributable to his negligence. But it must be remembered that though the insured is bound to do his best for his insurer, he is, not bound to do so at the risk of his life.

The insured must not neglect and behave irresponsibly during such events just because the property is insured. Hence it is the responsibility of the insured to protect his insured property and avoid further losses.

Related Links

You May Also Like

-

What is Life & Health Insurance Industry?

Insurers in this industry directly underwrite insurance policies relating to life, health, accident, and medical risks. Life and annuity insurance covers not only life and annuities but also health and disability. Read more about the health and life insurance industry. Life and health insurers generate revenue not only through the specific activity of insurance underwriting but also by investing premiums.

-

What is Finance? Meaning, Definition & Features of Finance

Finance is the science around the management of money. Finance encompasses banking, credit, investments, assets, and liabilities. The finance function encompasses a variety of functions, activities, and processes. Finance also consists of financial systems. Acquisition, allocation, utilization, and channelizing the funds to maximize the shareholder's wealth. Finance includes public, personal, and corporate finance.

-

The insurance industry classifies the different products it offers by sector. The insurance sector is made up of companies that offer risk management in the form of insurance contracts. There are four main insurance sectors: Life & Health Insurance Industry, General Insurance Industry, Specialty Insurance Industry & Reinsurance Industry. This article describes the current insurance industry sectors and their associated activities, products, and services.

-

This article helps the student to understand the legal principles and provisions of the insurance law. Starting with the fundamentals from which law is derived, this article helps the student to understand the salient aspects of any insurance contract, the rights and obligations of parties to the contract, and the legal environment within which insurance practice is carried out. Explore the seven most important principles of insurance.

-

The Business Model of Insurance Industry

The insurance industry business model can be further categorized into two types of main activities, service domain, and support domain. Service domain activities make up the company's value chain and the support domain provides the infrastructure and support to sustain the value chain. Support activities may include corporate services, finance, human resources, or information systems, and technology.

-

Insurance is categorized based on risk, type, and hazards. Logically, any risk that can be quantified can potentially be insured. Understand the importance of insurance and the different types of insurances like Life Insurance or Personal Insurance, Property Insurance, Marine Insurance, Fire Insurance, Liability Insurance, Guarantee Insurance.

-

An article to explain key terms used in the Insurance Industry and Insurance Business. Also, learn about various operational and performance metrics used in the insurance domain. Learn the definition and meaning of insurance industry terms like insured, insurer, claim, reinsurance, policy, and policy premium, etc.

-

BFSI is an acronym for Banking, Financial Services, and Insurance and popular as an industry term for companies that provide a range of such products/services and is commonly used by IT/ITES/BPO companies and technical/professional services firms that manage data processing, application testing, and software development activities in this domain. Banking may include core banking, retail, private, corporate, investment, cards, and the like. Financial Services may include stock-broking, payment gateways, mutual funds, etc. The insurance covers both life and non-life.

-

A primary insurer purchases reinsurance to limit its exposure, usually to one specific type of risk, thereby diversifying its book of risk. Businesses in this industry focus on assuming all or part of the risk associated with existing insurance policies originally underwritten by direct insurance carriers. In other words, the primary activity of this industry is insuring insurance companies. Reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers.

-

Insurance policies are a safeguard against the uncertainties of life. Insurance policy helps in not only mitigating risks but also provides a financial cushion against adverse financial burdens suffered. From a macro perspective Insurance industry turns capital accumulates as premiums into productive investments thereby promoting trade and commerce activities which result in the sustainable economic growth of the economy.

Explore Our Free Training Articles or

Sign Up to Start With Our eLearning Courses

About Us

Learning

© 2023 TechnoFunc, All Rights Reserved